|

Did You Know You Can Buy Real Estate for Pennies on the Dollar through a Little-Known Government Program?

|

Hi, my name is Michael Williams. Hi, my name is Michael Williams.

I spent many years investing in real estate foreclosures and rental properties. I also read as many books as possible on the subject. When I stumbled into tax deed and tax lien investing, I couldn't believe it. I said to myself, "is this some kind of secret that very few know about?"

No, it's nota secret. In fact, it's not controlled by multimillionaires either. It is actually run by local governments, backed by billions of dollars of collateral, and anyone can participate.

ARE YOU CURIOUS?

Welcome to Tax Deed Investing!

Tax deed foreclosures are a special type of foreclosure with more power than a mortgage foreclosure. How does it work? Counties in some states foreclose on the properties and sell the property for literally only the taxes owed.

You can buy incredible properties at tax deed sales for 50%, 75%,

or more than 90% below market value. That's pennies compared to the inflated real estate prices we are experiencing.

And here's a little known secret. In states like Texas, Georgia, Delaware and Rhode Island, tax deeds carry a right of redemption bearing an interest rate penalty that can be as high as 25%. This means you get the full interest rate even if the tax deed is redeemed right after the sale, giving you annual returns as high as 300% per year.

-

Georgia = 20%; if redeemed within one year. If the property owner redeems in one month, your effective annual interest rate is 240%.

-

Texas = 25%; for most properties, when redeemed within 6 months. If the property owner redeems in one month, your effective annual interest rate is 300%.

The process works like this...you buy a tax deed and either the owner pays you back with interest or loses the property. The difference is you already own the property, but for a short period of time the owner, bank or other interested party can buy it back from you at a hefty price.

Here are the Tax Deed States and Canadian provinces:

Alaska, Alberta, Arizona, Arkansas, British Columbia, California, Connecticut, Delaware, Florida, Hawaii, Georgia, Idaho, Kansas, Louisiana, Maine, Manitoba, Michigan, Minnesota, Nevada, New Brunswick, Newfoundland, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Nova Scotia, Ohio, Oklahoma, Ontario, Pennsylvania, Prince Edward Island, Quebec, Rhode Island, Saskatchewan, Tennessee, Texas, Utah, Virginia, Wisconsin and Washington.

Success in life is often about finding hidden opportunities before everyone else, and tax deed sales are definitely a hidden investment opportunity. Are you still wondering if tax deed investing is for you?

Here are some happy tax deed investors after a sale in Texas.

This economy may be bad for some, but YOU can take advantage of the uncertainty.

Now, if you thought that was exciting, how about earning high interest rates on properties without painting picking up a hammer? I am talking about Tax Lien Investing.

It is the perfect economy for you to be a Tax Lien Investor.

Why?

Interest rates are high and liens are plentiful. Interest rates are high and liens are plentiful.

Liens are available for purchase online and over the counter. Liens are available for purchase online and over the counter.

What's exciting is that many counties in states across the U.S., like Maricopa County in Arizona, are holding their sales on the Internet rather than at the courthouse, making travel expenses and time away from home a thing of the past.

Florida is a state where many of the counties are conducting their tax lien certificate sales online. And certificates that remain unsold are later available for purchase through the mail from the county, with the buyer receiving the full state-mandated annual interest rate of 18 PERCENT.

AMAZING!

Even if you are not comfortable with the Internet, you can simply purchase over-the-counter (OTC). If you are hands on and would rather go to the County, signup and buy OTC tax lien certificates, you are in good luck. There are even a few places where you can use the postal mail.

Now, you may wonder whether this investment strategy is out of your reach.

It's NOT!

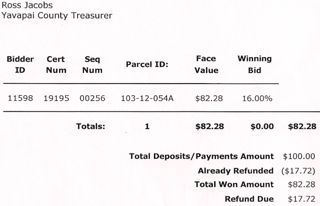

Here is a tax lien certificate that I purchased online for $82.28, which earned 16% interest:

You don't have to have a job or perfect credit!

|

NO CREDIT SCORE OR JOB REQUIRED!

County governments do not check your credit score or make sure you have income from a job. They only check your name and social security number or Employer Identification Number (EIN) (if you are a business) to make sure you don't owe any taxes in their county. That's it!

Your credit score can be a 550, 600 or 750.

It's easier to buy a tax lien than rent an apartment.

|

In most cases, you do not need to be a U.S. citizen to invest.

If you live outside the U.S., you can either apply for a tax identification number from the Internal Revenue Service, or set up a U.S. company to invest for you. There are a couple exceptions based upon the States, but I will show you how even if you are from Canada, the United Kingdom, New Zealand, Australia or anywhere in the world.

You can even take money from an Individual Retirement Account (IRA) and use it to invest in tax liens.

Are you beginning to see how safe and powerful tax lien certificates are?

Tax Liens...Unleashed!

Welcome to the Tax Liens Unleashed, a book and online course designed to show you how to earn huge investment returns from this little known investing strategy that is controlled by the local government and backed by real estate.

Let me explain...

The collection of property taxes is a huge priority in every city and county in the United States. Literally, if a county cannot collect property taxes, it will go broke.

To make sure this doesn't happen, in tax lien states the county places a lien on any property with delinquent property taxes and sells the debt to investors. This creates a win-win situation for everyone: the county gets its money, delinquent property tax owners get a little extra time to pay their overdue property taxes, and investors get a low risk, high return investment.

How high are the rates of return on tax lien certificates?

-

Illinois = 18% (6 months)... that's 36% per year.

-

Indiana = 10% flat fee for the first 6 months or 15% for the second 6 months. On an annual basis, your return could be an amazing 120%.

-

Florida= 18% (per year); on an annualized basis your return can be an impressive 60%.

-

Iowa = 24% (annual return).

There are many States that offer tax lien certificates:

Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, New York, Nevada, South Carolina, Vermont, Washington D.C., West Virginia, and Wyoming.

But what about investment safety? Are tax lien certificates a safe investment?

Investing in tax lien certificates is ultra-safe!

What makes tax lien certificate investing SAFE is that the sales are governed by state law and conducted by the tax collecting jurisdiction (typically the county), and your investment is backed by real estate.

What do I mean by this?

Well, if the property owner pays his/her taxes plus interest due to the county within the time allowed following the sale (the "redemption" period), then the county receives its property taxes and you receive your money back plus interest. If the property owner does not pay his/her taxes plus interest back within the redemption period, then the county keeps your invested money and you can foreclose on the property. In all but two states, the MORTGAGE IS WIPED OUT through the tax foreclosure process.

Consequently, you will EARN HIGH RETURNS or you will own the property.

1. State governments control the entire tax lien process so it is very safe and fair. The last thing the state or county wants is an unsatisfied tax lien investor. Without the investors, counties would not be able to collect the money they need to keep their governments operating.

2. If a delinquent property tax owner fails to pay his/her back taxes plus interest, you can foreclose on the property for only "pennies on the dollar."

3. A tax lien has priority over a mortgage lien. That means that the mortgage (in all but two states) is eliminated.

Let me be clear...

You Do Not Have to Pay the Mortgage!

Now do you understand why tax lien certificates are an

incredible investment with a great built-in safety factor?

If the delinquent property owner pays his/her tax bill, you, the investor, make spectacular returns on your money.

If the property owner fails to pay the tax bill, you get to keep the entire property for the taxes and penalties owed, often pennies on the dollar.

|

Not even the mortgage can stop you!

|

Tax lien investing doesn't depend on the economy, so you Don't Have to Worry About Your Investment Going Up and Down from one day to the next. If you're like me, you have enough worries. Investing shouldn't be one of them.

Instead of going up and down like the stock market, tax lien certificates just rise in value.

You cannot find a higher return,

lower risk investment than tax lien certificates.

|

|

It's a Fact!

Tax lien sales are controlled by state laws and

run by a government process making it extremely SAFE.

Tax lien certificates are backed by real estate for added safety.

|

|

Did You You Know You Can Purchase Tax Lien Certificates and use a Self-Directed IRA to PAY NO TAXES OR DEFERRED TAXES ON YOUR EARNINGS?

Oh, you didn't know that could be done. Well, you are in for a treat.

|

It's a Fact!

You can buy tax lien certificates using money

from a Roth or traditional self-directed IRA.

|

|

Are you starting to feel better about this safe, higher yielding alternative to stock investing?

If you thought tax lien certificates were a great, undiscovered real estate investing secret, welcome to tax deed sales.

When you study the facts, investing in tax liens and tax deeds is one of the safest and quickest ways to achieve FINANCIAL INDEPENDENCE.

Even financial institutions have found tax sale investing to be lucrative.

Did You Know You Can Buy Tax Lien Certificates

Online Or by Mail Without Traveling?

|

|

You do not need a special license to invest in tax liens or tax deeds. The sales are open to the general public. Even non-U.S. residents can invest. I will show you how to easily get a tax I.D. number. And if you are intimidated by the thought of attending a public auction, or don't want to take time off from your daily life to travel to an auction (and pay the travel expenses), don't let that stop you from investing in tax lien certificates or tax deeds. Many counties in states like Arizona, California, Colorado, Florida, Illinois and Indiana are now conducting their sales using Internet auctions, and this trend is only likely to continue. If you have ever purchased an item on eBay, you already know how to maneuver an online tax lien auction.

It's as easy as eBay!

You can also purchase tax lien certificates and even tax deeds that were not sold at the original tax sale through the mail, usually with no competitive bidding, in Alabama, Arizona, Florida, Texas and 12 other states. For tax liens, that means you get the full interest rate allowed by state law. And for tax deeds, that often means you can get the property for only the taxes owed.

NOW, Would You Consider Joining Me and together we will explore tax lien and tax deed investing, including how to set up a tax lien business, buy with a self-directed IRA, and more?

Let me show you how we can work together.

|

TAX LIENS UNLEASHED COURSE

- TAX LIENS UNLEASHED EBOOK (2025). This book has the same information I taught for years in my 3-day workshops that I sold for $1997. The Tax Liens Unleashed book is now made available in a fun and educational style. Don't buy another boring book when you can quickly learn how to invest in tax liens, tax deeds, and real estate. It's more than a book - it's a learning experience.

- Personal Mentoring

Call me crazy, but I am offering one-on-one personal mentoring by email for the next 90 days. I only ask that you work through and finish the book, then we can discuss your goals, where you want to invest, and any concerns or questions you have.

- ROGUE REAL ESTATE INVESTOR COLLECTION EBOOK. A comprehensive guide to tax lien and tax deed investing, plus profiles of all 50 States and Canadian provinces. The Rogue Investor Collection has 3 books in one: Rogue Real Estate Investor, Rogue Tax Sale Investor and Rogue REIT (Real Estate Investment Trusts) Investor. In this Collection you will learn about real estate foreclosures, buying tax liens using a self-directed IRA, setting up a business using an LLC and much more. Over 800 Pages of Tax Lien and Real Estate Foreclosure Information.

- OVER-THE-COUNTER (OTC) TAX LIEN AND TAX DEED SUPERLIST (2025). Links to County web pages that offer information and their lists for purchasing over-the-counter tax liens and tax deeds!

These lists contain thousands of liens and deeds that can be purchased through the mail and online. Here are a few States that are included:

- Alabama

- Arizona

- Colorado

- Florida

- Illinois

- Pennsylvania

- and more...

- TAX SALE CALENDAR RESOURCES (2025). Our list of over 30 RESOURCES for finding upcoming county and municipal public and Internet tax lien and tax deed sales dates and lists.

- WEBINAR ON TAX LIEN INVESTING. This webinar cover liens, deeds, secrets of tax sale investing, due diligence, screening and more. A slide presentation accompanies the audio recording.

- PREMIUM REPORTS. Access to over 25 premium reports in which I profile a State, County or topic that will help jump start your tax sale business and investing.

You will receive access to the product, available entirely online, immediately upon purchasing.

Who am I?

In 1992, I started investing in government foreclosures, mainly from the Veteran's Administration (VA). I learned how to buy with little money down, maximize cash flow through the rental market, and hold certain properties and sell others.

About 10 years later (2002), I literally stumbled into Tax Lien Investing. I couldn't believe what I was hearing, so I set out to investigate the details (you see, I am a scientist [geologist] by training). I read several books and tried to find other good books, but most were outdated. In the end, I decided to compile the information myself and write my own books and courses because State laws change so quickly. Well, the rest is history. I have been investing in tax liens and tax deeds ever since, and I have helped others do the same through books, courses and workshops.

In fact, I have been invited to speak with industry giants, such as Harv Eker (The Millionaire Mind), and I have been quoted in Money Magazine on the topic of tax liens. I only say this to let you know that you are getting access to experience.

|

|

|

Here's what Steve Gadson and others had to say after purchasing the Rogue Real Estate Investor Collection and Membership:

|

My name is Steve Gadson. I've been researching real estate investing and tax liens for a few months and have ordered all the Carlton Sheets products. They are so vague. And you can't possibly learn all the material because you can't understand the lingo. Your collection is great! It explains so much. At 27 I hope to use the information to attain my goals both financial and personal. As a professional consultant, the market has taken my position with a very affluent corporation, Verizon, and put it into much jeopardy. My job is at stake every day! Thank you for sharing this information with people like myself who want to truly make this life successful, and take knowledge and apply it. One day after reading the first couple of sections much of the information I've been researching is finally making sense. Again thank you! I'll update you on my successes!

Steve Gadson (unsolicited response)

I wanted to let you know that I've spent the last several hours reading the Rogue Real Estate Investor Collection and I'm having a great time with it. It's a terrific read and you should be complimented with the care and detail you've put into it.Thank you very much,

Rob Durstewitz (unsolicited response)

Thank you very much for the prompt response. I greatly appreciate it. Your program material looks awesome!

Lance Buser (unsolicited response)

Thanks! Will begin reviewing the material. It is, by far, the best material I've seen on the subject.

William B. Brooks (unsolicited response)

A few months ago I purchased your complete package... that is the Rogue Investor Real Estate Investor Collection. I would like to comment on the great news letters that you send out. It was a really good choice to go with your program.

With kindest regards,

Till Schilling (unsolicited response)

By the way, of all the many "Tax Sale" information books & sites, yours is at the very top of the list.

Larry Milligan (unsolicited response)

This is one of the best books I have invested in and after years and years of reading about real estate, this book is going to get me in the game.Thank you

Rick Clark (unsolicited response)

I have begun reading the Collection. I also plan to attend the upcoming auction in Illinois. I'll e-mail the details of my very first auction.

As I continue to educate myself about Real Estate Investing (thanks to Rogue Investor) my life is already beginning to change.

I look forward to the continued support that is being offered.

Thanks,

LeRoi Adams (unsolicited response)

Thanks again for all your help. The information in your collection to date has been comprehensive and has given us a realistic appreciation of the pros and cons to tax lien investing. Your info is organized in a user friendly way and your ranking system was nice for someone like me who is new to this investment strategy because it gave me an intelligent way to be able to compare and contrast different states based on my objectives. Keep up the good work and please feel free to use my comments for a testimonial if appropriate. Happy New Year to you and your staff!

Lori Wloch-Diamos (unsolicited response)

|

|

I would like to help you experience this exciting investing strategy, but I know some of you are anxious to get started that's why...

I literally condensed about 1000 pages of information into 10 pages or about 10 minutes of your time.

I know you are busy, so that's why the first 10 pages of the Tax Liens Unleashed ebook are enough to get you started right away. For those of you who are interested in reading on, there are 290 more pages in Tax Liens Unleashed and 800 pages in the Rogue Real Estate Investor Collection.

**Sometimes you just want to get to the point as quickly as possible. In only 10 pages (about 10 minutes of reading) of the Quick Start Guide in Tax Liens Unleashed, you will be ready to get started. Put everything else aside. When you need to use it as a reference, you have it. In the meantime:

On Your Mark, Get Set,

GO!**

|

IMAGINE what it will be like as your investments race past your wildest hopes and dreams!

YOU WILL GET ALL OF THE ABOVE FOR ONLY $1997...$497...$147!

TO ORDER NOW, Click the BUY NOW Button Below.

|

|

|

In addition to everything else, you also get my NO HASSLE GUARANTEE. When you order, you will not be hit up for any other offers, period! In addition to everything else, you also get my NO HASSLE GUARANTEE. When you order, you will not be hit up for any other offers, period!

You will not be asked once, twice, even seven times to buy other products from me.

You will pay once and get all the training you need.

|

ORDER NOW AND RECEIVE THESE FREE GIFTS!

|

FREE Gift #1

|

|

The 7 Best Tax Lien States

|

You can waste a lot of time trying to find the best states for tax lien investing or you can read this bonus gift and know immediately which states you should focus on.

The best tax lien states have high interest rates, short redemption periods and great support by the state and counties involved in the sales.

Until now, no one has developed a comprehensive rating system that incorporates all these factors. With this free gift all the hard work has already been done for you!

|

|

FREE Gift #2

|

|

The 4 Best Tax Deed States

|

With this free bonus gift, you will know exactly which states make it easy to purchase tax foreclosed properties for pennies on the dollar.

SIMPLY said...no more.

|

Listen to what others have said.

Testimonial

Michael, I invested in the course back in 2006 (never regretted it, by the way). I had purchased two tax liens in Illinois back in '06, and just wanted to give you an update. I won both bids at 17% and the first one redeemed within the first six months (good return!). The second I had to put two extensions on the redemption period, due to a lack luster attorney, and had gotten to the point of petitioning the court for deed and sending out final notices. This property had an income producing cell tower on it (nice tenant) and I was praying it would become mine. Well, the lessee ended up redeeming and you can do the math-it was a great return. Thank you so much for your information and the sharing of your wisdom and knowledge.

Luck in all your endeavors

Jenni Swiatek

Testimonial

I got your course a few months back. It's the best and most comprehensive thing out there on the subject of tax deeds and liens that I could find - and I looked everywhere.

-Brennan

I challenge you to find a more comprehensive, current and affordable product

covering every aspect of tax lien certificate, tax deed and foreclosure investing on the market.

You Pay ONLY $1997...$497...$147!

You can't get this anywhere else!

Order securely as a PayPal Guest, through your PayPal or Venmo account

ORDERING IS EASY!

ONLY $147!

Click on the Buy Now buttons below and order through Mind Like Water, Inc.'s PayPal secure server.

If you do not have a PayPal account, you can pay with a debit or credit card as a PayPal guest. Just click on the "Buy Now" button below. Then choose the second payment option: "Pay with a debit or credit card, or PayPal credit" and provide the billing information requested.

After ordering, you will be immediately redirected to a web page which provides instructions for accessing all of the components of your Tax Liens Unleashed Online Course and Premium Member Service.

Here's to you your success,

Michael Williams

P.S. We offer a 100% Money Back Guarantee.

P.P.S. This offer will end on Friday at Midnight, U.S. Pacific Time. Don't miss out on Premium Membership, mentoring, online course, OTC Guide, plus a brand new (2025) tax lien book. Price will increase to $197...hurry don't miss out.

|

Was $1997... now only $147

Still have questions, email me at michael@rogueinvestor.com

Order securely online.

|

Copyright 2000-2025 Copyright 2000-2025

Home Page: www.rogueinvestor.com

5400 Johnson Drive, #106, Mission, KS 66205

|

|