Dear Premium member:

As promised, here is part 2 of this special two part series.

“Assignment” of a tax lien certificate is simply the process by

which the holder of the certificate changes from one party to another.

The assignment of tax lien certificates may be conducted by

individuals, or by the taxing jurisdiction itself (e.g., counties and

municipalities).

Individuals

Perhaps you have decided that it is time to sell your tax lien

certificate. You may want to buy something different, or you may just

want the cash. Many state tax sale laws allow the assignment of a tax

lien certificate from the holder to another party (the assignee).

Because the state law may give individual counties a choice in allowing

this, you will need to contact the county to ask if they allow

assignments, if there is a grace period for doing so, and what the

process is.

The county may require a grace period of six months to a year before

you can assign a certificate. Typically, the county will charge a fee

to process the assignment (in Douglas County, Nebraska, the fee is

$10), and documentation on the party the certificate is being assigned

to. Most counties want to be sure that the certificate holder does not

have any outstanding taxes or other fees due to the county.

Taxing Jurisdictions

In many states, when a certificate goes unsold at a sale the lien is

sold to the county itself (or other taxing jurisdiction). Because no

one bid on them, these certificates always accrue the highest interest

allowed by state law. Typically, the county can either assign these

certificates “over-the-counter” (i.e., you can purchase certificates

directly from the county through the mail) or foreclose on them and

then sell the properties. Counties generally aren’t in the business of

owning and selling real estate, so assigning the certificates is a more

attractive option to them. In addition, foreclosing and selling

property takes time and has added costs associated with it.

Assignees

As an assignee, you will want to understand the tax lien certificate

process in the county you are buying a certificate in, the collateral

for the tax lien, and what the rate of return is for your investment.

Although the assignment does not represent a sale of real, physical

property, you should do your due diligence on the property in case you

have the opportunity to foreclose on it. You should ask yourself why

this lien wasn’t purchased at the sale.

XSPAND

XSPAND is a subsidiary of JPMorgan Chase & Co. that, among other

services, markets tax lien certificates to investors for assignment (http://www.xspand.com). You can view listings of tax lien certificates that are available for assignment on their website (http://www.xspand.com/investors/tax_liens_sale/index.aspx),

as well as an explanation of the law and procedures governing the sale

of these certificates. These tax liens are listed by jurisdiction and

can be purchased in some cases at full redemptive value and in others

at a discount from full redemptive value. As of this writing, XSPAND

has tax lien certificates available for assignment in Cuyahoga, Stark

and Lucas counties in Ohio; and in Erie County, New York.

XSPAND outlines the following steps for purchasing a tax lien by assignment:

-

Once you've determined the jurisdiction(s)

in which you have an interest, thoroughly familiarize yourself with the

legal requirements in that community.

-

Review

our listings and assemble your list of desired Tax Lien ID's. Email

your selections, asking price, contact information and interested date

of assignment to investor@xspand.com. Please keep in mind that they generally require at least one week to respond to assignment information requests.

-

One

of our Asset Managers will review and analyze this list and notify you

by email which liens are available and the final assignment price for

each. There is the potential that not all of the liens you requested

will still be available as interest in assignments of tax certificates

can be quite high and liens regularly redeem. Furthermore, in certain

jurisdictions, government approval of your assignment offer may be

required and allowance should be made as to the turnaround time once an

offer has been made.

-

Review this list and

contact our Asset Manager to discuss the steps necessary to complete

the transaction. In some cases a deposit may be required but in all

cases you will need to remit payment by wire transfer or cashier's

check once a final agreement has been reached on the terms of the

assignment.

-

Upon receipt of funds XSPAND will send you the appropriate tax certificates and/or endorsements

-

Upon

receipt of the assigned certificates you should be aware that you may

be required to record your interest with the applicable party in each

jurisdiction.

In this report, I will focus on the Cuyahoga County, Ohio list of

tax lien certificates available for assignment. XSPAND obtained the tax

liens through a negotiated sale with Cuyahoga County. In Ohio, only

counties with populations of 200,000 or more are allowed to sell tax

lien certificates, and the liens are sold in bulk only (and not to

individual investors). Twelve of Ohio’s 88 counties qualify to hold tax

lien certificate sales, including Butler, Cuyahoga, Franklin, Hamilton,

Lake, Lorain, Lucas, Mahoning, Montgomery, Stark, Summit and Trumbull.

As an example, the portfolio of tax lien certificates available for

sale this November by Franklin County is estimated to be $3 to $6

million. Ohio Revised Code (ORC) 5721.30 et seq. governs the sale of

tax lien certificates.

The bidding on a portfolio of lien certificates begins at the

statutory maximum interest rate of 18% simple interest annually, until

the lowest interest rate bid is reached.

Twelve months after the sale date, the tax lien holder has the right

to foreclose on the property. The tax lien holder also has the option

to wait until the end of the three-year lien period, allowing the

interest to accumulate, and foreclose at the end of the three-year

period.

The bid interest rate of the successful bid applies to the entire

amount of each lien, including the administrative fee. Interest is

calculated on a simple interest basis with 1/12 of the annual interest

applied on the first day of each month.

“Certificate interest period" means the period beginning on the date

the certificate is purchased and ending on one of the following dates:

(1) In the case of foreclosure proceedings instituted under ORC

5721.37, the date the certificate holder submits a payment to the

Treasurer under division (B) of that section;

(2) In the case of a certificate parcel redeemed under division (A)

or (C) of ORC 5721.38, the date the owner of record of the certificate

parcel, or any other person entitled to redeem that parcel, pays to the

County Treasurer or to the certificate holder, as applicable, the full

amount determined under that section.

The purchaser of a tax lien certificate has the right to purchase

the lien on all subsequent delinquent taxes on any parcel for which the

purchaser holds a tax lien certificate. The interest rate on a tax

certificate for subsequent delinquent taxes is 18% simple interest.

Lien certificates are valid for a period of three years from the

date of purchase. The date of purchase for purposes of the lien

certificate expiration date is be the auction date. If the expiration

date fall on a weekend, the tax lien certificate expires on the next

subsequent business day.

Foreclosure of the tax lien certificate parcels is governed by ORC

5721.37. Foreclosure cannot begin until one year from the date of sale

of the tax lien certificate. A recent change to state law permits the

lien holder to secure private counsel to initiate foreclosure or

utilize the County Prosecuting Attorney Office to prosecute the

foreclosure actions.

The prosecuting attorney may charge the tax lien certificate holder

a fee to cover the cost of prosecuting the foreclosure action. The fee

may change from year to year. As an example, in 2006 the Franklin

County Prosecuting Attorney's Office has charged a $3,500 fee for

handling the tax lien foreclosure actions.

The following additional instructions are provided by XSPAND for obtaining a lien:

-

Contact Mr. Defransisco at 800-575-9890 for instructions on obtaining a tax lien assignment.

-

XSPAND

does not provide due diligence and it is the purchaser's responsibility

to perform due diligence and obtain a title search to determine whether

there are other liens on the property.

-

Purchasing

a tax certificate does not transfer or give the purchaser any ownership

of the property and all existing liens remain in place against the

property. We recommend that you consult an attorney.

-

Submit your offer in writing to XSPAND at 113 St Clair Ave., Suite 150,

Cleveland, OH 44114. Submission should include the name of the person

or entity desiring to purchase the lien, contact information, tax ID

number for the purchaser, reason for purchase and a description of what

the purchaser intends to do with the tax lien upon ownership.

-

A

representative of XSPAND will contact you directly to set up a time for

the transfer of the certificates and with payment instructions.

-

Payment for assigned liens must be made with certified funds made payable to Plymouth Park Tax Services.

-

In

addition the transfer fee for the Cuyahoga County Treasurer and the

recordation fee for the Cuyahoga County Recorder will be the sole

responsibility of the purchaser.

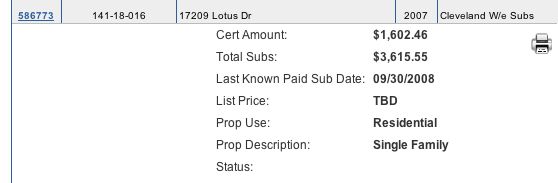

For each lien listed, the following information is provided: BHID

number, parcel number, location, lien year and city. Clicking on the

BHID number expands the listing information to include:

-

Cert amount: This is the tax lien amount or minimum taxes owed.

-

Total subs: These are subsequent taxes owed.

-

Last known paid sub date:

-

List price: This is the price they are selling the liens for, which could be full price or a discount.

-

Prop use: for example, residential

-

Prop description: for example, multi-family =< 4 units

-

Status:

According to XSPAND, additional fees and interest are attached to all cert and sub amounts.

Let me explain. This means that they bought a huge package of liens

directly through the County, as allowed by State law. Most of the liens

were redeemed and they likely earned the full interest rate allowed by

law, which is 18%. They have held on to the liens waiting for a

redemption and now they are prepared to sell the liens because they

don't want to foreclose on these liens, but rather just earn an

interest rate and be done with it.

For example, the redemption period is 3 years in Ohio so liens

purchased in 2007 have exceeded the redemption period and foreclosure

proceeding may be initiated. This will either be a final wakeup call

for the property owner to redeem and pay the delinquent taxes or he/she

risks losing the property.

Let's do an example:

Visit the website at www.xspand.com and search for the Cuyahoga,

Ohio Tax Lien List. You will see an extensive list that looks like this:

BHID |

Parcel # |

Location |

Lien

Year |

City |

586773 |

141-18-016 |

17209 Lotus Dr |

2007 |

Cleveland W/e Subs |

Screening an over-the-counter or assignment list includes one

additional component that I haven't talked about before - - the lien

year. In general, new liens will be better and older liens will involve

much more research and more risk. That's because they have been

available for longer and have gone through scrutiny by many other

investors.

Looking at the Cuyahoga list, I would focus on the most recent liens

(2007). Looking at the list and working backwords, the first lien looks

pretty good.

First, use the pull down menu and you will see that $1602.46 is the

certificate amount and the company has paid an additional $3615.55 in

subsequent taxes (taxes occuring after they bought the 2007 lien,

probably two years worth).

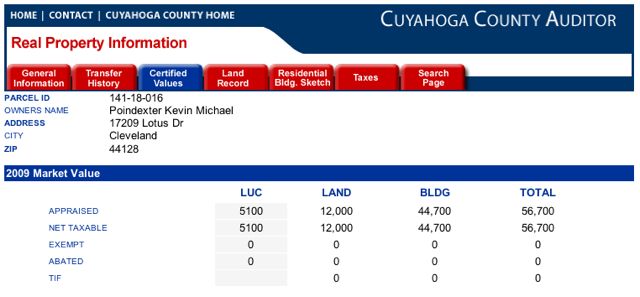

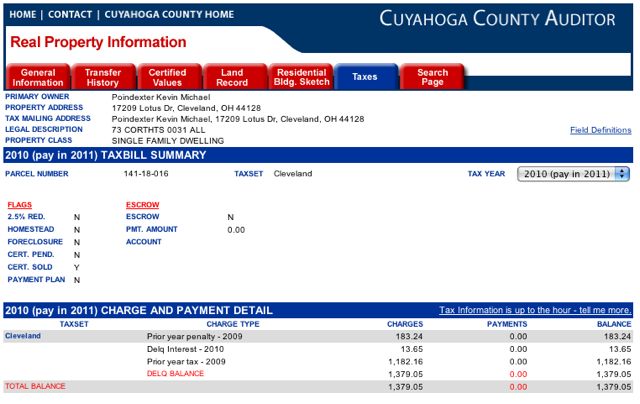

Now, let's see what is still owed at the County. Looking on the

search box and using the Parcel #, the current amount due in delinquent

taxes is $1379.05

http://auditor.cuyahogacounty.us/REPI/default.asp

17209 Lotus Drive, Cleveland, Ohio

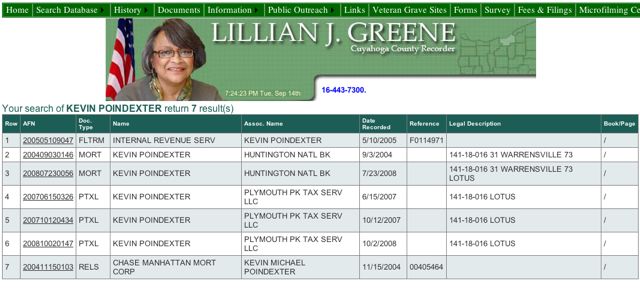

http://recorder.cuyahogacounty.us/Searchs/GeneralSearchs.aspx

Now, here is your assignment should you choose to accept this crazy mission.

Answer the following questions:

Does Keven Michael Poindexter have a mortgage on the property at 17209 Lotus Drive?

Are there any other recorded liens and by whom?

Can you find the tax liens? How many tax liens have been purchased?

How much does it cost to assign a lien in Cuyahoga?

Does the certificate amount include the interest that the company

Xspand (Plymouth Park Tax Services, LLC) hopes to make? If not how much

more would that be?