Dear Premium members:

First read through this discussion on Bid4Assets

so you can understand

how to signup and navigate their online bidding system.

Then, continue on below to the Benton County tax

foreclosure sale.

Bid4Assets

(“B4A”) is

an online auction marketplace for high-value assets like real estate.

County government agencies partner with B4A to sell, among other

things, tax-defaulted property online. According to B4A, they are the

largest seller of tax-defaulted properties on the Internet. They assist

more than fifty counties nationwide with bringing their tax sale

auction process online.

http://www.bid4assets.com

An auction calendar for

county tax sales is at

http://www.bid4assets.com/help/index.cfm?fuseAction=TaxSale. Upcoming

county auctions are continuously added to the site's calendar. You can

also sign up for the B4A County Tax Sales Email Alert

(http://www.bid4assets.com/storefront/?sfID=69)

to be notified when new

sales are introduced to the site. Alerts are typically sent out within

two business days of when a county auction goes on preview. You must be

a registered user to receive the alert.

B4A offers a number

of tools and resources to potential investors to enhance their buying

experience. Besides the County Tax Sales Email Alert, they include the

following:

How to

Participate in a B4A County Tax Sale auction:

Learn how to most effectively navigate their website and quickly find

what you’re looking for with B4A’s user-friendly, step-by-step guide to

participating in County Tax Sales.

http://www.bid4assets.com/help/index.cfm?fuseAction=howToParticipate

Frequently Asked Questions: Answers to 19 frequently asked questions.

http://www.bid4assets.com/help/index.cfm?fuseAction=TaxSaleBuyerFAQ

County Tax Sales Glossary of Terms: Terms includes definitions to all

the key tax sale auction terms.

http://www.bid4assets.com/help/index.cfm?fuseAction=TaxSaleGlossary

National

Association of Counties: Link to the organization representing the

nation's County governments. On the NACO website you will find contact

information for County officials, state maps showing county boundaries

and more.

http://www.naco.org

There are no fees to

participate in a county tax sale auction. However, according to the

FAQs, anyone who wishes to bid at the online public auction must

register with B4A and submit a pre-bid deposit within the posted

deadlines to qualify as a bidder. A bid deposit helps a taxing

authority ensure that only qualified and authorized bidders participate

in its auction. Funding of a bid deposit account demonstrates a

bidder’s ability to comply with a County’s Conditions of Sale and

ensures performance of a winning bidder. A winning bidder’s deposit

becomes a non-refundable down payment on purchases. However if you do

not win any tax sale auctions your deposit will be refunded to you.

Steps for

Participating in a County Tax Sale

The

steps for participating in a county tax sale

(http://www.bid4assets.com/help/index.cfm?fuseAction=HowToParticipate&#auctionends)

are as follows:

Registration

Registration

is required to participate in any County Tax Sales. The process is

free, easy and only takes a few minutes to complete.

You should first read through the terms and services at

http://www.bid4assets.com/Help/index.cfm?fuseAction=termsofservice.

Property

Research

B4A

urges interested bidders to examine the title, location and

desirability of the properties available to their own satisfaction

prior to the sale. A complete list of properties available for auction

is posted for viewing and downloading three to four weeks prior to the

auction date. When you find an item you're interested in bidding on,

B4A recommends you make sure you read the entire listing description

and any additional information included in the "Additional Details" tab.

After

reviewing the information included in the auction listing, B4A

encourages you to contact the Tax-Collectors Office of the County in

which the property you are interested in is located if you have

additional questions. This information can be found in the center of

the County specific storefronts.

For questions regarding the auction and the bidding process, you can

contact service@bid4assets.com.

It's

important to remember that bids are binding contracts; if you are the

winning bidder, you are legally obligated to purchase the item. Make

sure you have done all necessary research before moving forward with

your bid.

Place Deposit

Most

counties require bidders to place a deposit prior to placing their

first bid. A "BidDeposit" helps the County ensure that only qualified

and authorized bidders are participating in its auction. Generally a

"BidDeposit" is good for bidding on any and all auctions within that

County and will not be transferable from County to County. Deadlines to

place your deposits are set for 7 days before the close of the last

auction for a particular County. "BidDeposit" deadlines, specific to

the County you are interested in, are located on the County Specific

Storefront.

The acceptable forms of deposit method vary by

County. County-specific deposit instructions are located under the

General Tax Sale Information tab in the "County Terms of Sale"

document. B4A does not charge a fee to place a BidDeposit.

A

step-by-step guide on how to place a bid deposit is available at

http://www.bid4assets.com/help/index.cfm?fuseAction=howToBid.

See also

the information provided at

http://www.bid4assets.com/help/index.cfm?fuseAction=howToBidDeposit.

You should review both of these guides.

Rogue Investor Note: A

deposit is not required to participate in the Benton County, Washington

tax-defaulted property auction. For auctions that do not require a

deposit, B4A requires that a bidder provide a valid credit card or

debit card number prior to pacing a bid. B4A will confirm that the card

is valid but will not charge your card or place a "hold" on funds. The

process is free, quick and secure and, if successful, your bid is

placed immediately.

Bidding

Only registered B4A users can place a bid.

Auto

Bid is a maximum bid which is held in confidence by the system. B4A

will use only as much of the maximum bid as is necessary to maintain

the bidder's high bid position or to meet the reserve. (In Reserve

Price Auctions, if your maximum bid is the first to meet or exceed the

seller's reserve price, the system will automatically move your bid up

to meet the reserve, and bidding will continue from there.)

The

System will default to Auto bid if not instructed to do so otherwise.

To choose a Flat bid option, click on the radio button next to Flat

Bid.

When you are ready to place a bid, choose a bid

type, enter your bid amount in the Bid Amount box and click on the Bid

on this item button. You will be prompted to login (or register, if you

haven't already).

Once you've submitted your bid, you will

receive a bid confirmation notice via email and a similar notice will

be placed in your My Messages in-box located within My B4A.

A

more comprehensive, step-by-step guide to bidding is available at

http://www.bid4assets.com/help/index.cfm?fuseAction=howToBid.

You

should review this information.

You can monitor your with

B4A’s auction management center, My B4A. You will also receive county

auction updates in your My Messages center also located in the My B4A

section of the site. (Please note: Includes information on counties

withdrawing properties. Also, when a property is withdrawn from a B4A

County Tax Sale auction the word “withdrawn” is added to the auction

listing title alerting bidders that the property is no longer

available.)

Frequently asked questions about bidding are at

http://www.bid4assets.com/help/index.cfm?fuseAction=buyerBidding.

When an

Auction Ends

If

you are the winning bidder of a County Tax Sale auction, you will

receive an e-mail (and message in your My Messages in-box) from B4A

with settlement and deed transfer instructions within 24 hours. As a

winning bidder your deposit will be transferred to the County Tax

Collector as a non-refundable down payment for the property. Your bid

is a binding contract.

If you are not the winning bidder

on the auction, your deposit will automatically be refunded within 10

business days of the close of the auction.

Online check

deposits are refunded by online check (ACH) to the originating bank

account within 10 business days of the day the auction closes.

Check

or wire deposits are refunded by check, to the name and address

provided in your Bid4Assets profile, within 10 business days after the

close of the auction. To confirm your profile information, click on the

My Profile link located in My B4A.

Frequently Asked Questions About Bidding

B4A

provides the following answers to frequently asked questions about

bidding at

http://www.bid4assets.com/help/index.cfm?fuseAction=buyerBidding.

Who can bid?

Only

registered Bid4Assets users and those capable of forming legally

binding relations under applicable law can place a bid. Click here to

register

(https://secure.bid4assets.com/Register/index.cfm?fuseaction=startReg)

or refer to the Terms of Service for more information on who can bid.

How do I bid?

Before

placing your first bid, thoroughly review the auction description and

any additional details included in the listing. Remember, it is

incumbent upon the bidder to verify all information provided and

conduct additional research before placing a bid.

When you

are ready to place a bid, choose a bid type, enter your bid amount in

the Bid Amount box and click on the "Bid on this item" button. You will

be prompted to login (or register, if you haven’t done so

already.)

For auctions that do not require a deposit,

Bid4Assets requires that a bidder provide a valid credit card or debit

card number prior to pacing a bid. Bid4Assets will confirm that the

card is valid but will not charge your card or place a "hold" on funds.

The process is free, quick and secure and, if successful, your bid is

placed immediately.

Verify your bid amount and check the boxes

next to “I have reviewed and researched asset details to my

satisfaction and Bid4Assets Terms of Service and I agree to allow my

credit cared to be charged $250 in the event I am a non-performing

bidder”. Then input your credit card information – if you have

previously bid and want to use the same credit card you can check off

to use your existing card or input new credit card information. Enter

your password and click on the Bid Now button.

If a bidder does

not complete a transaction after placing a winning bid, their card will

be charged $250 for a real estate auction and $100 for all other

auctions.

If the auction has a deposit requirement, follow

the instructions for your preferred deposit method.

Click

here for a more comprehensive, step-by-step How to Bid guide:

http://www.bid4assets.com/help/index.cfm?fuseAction=howToBid

What is an Auto Bid?

Auto

Bid is the maximum bid you’re willing to bid on the auction. Bid4Assets

will automatically increase your bid to maintain your high bid position

or to meet the reserve price.

Please note: If two bidders

place auto bids for identical amounts on the same auction, and this

amount is the high bid when the auction closes, the first auto bid that

was placed will be the winning bid.

Our system defaults to Auto bid. To choose a Flat Bid option, click on

the radio button next to Flat Bid.

Examples of Auto Bid:

A)

If the auction has a minimum bid of $200 and you enter your maximum bid

amount of $400, your bid will automatically be placed at $200. Your bid

will automatically increase as other bidders participate, up to your

$400 maximum bid amount.

B) If the auction has a Reserve

Price of $20,000 (this amount is hidden from bidders) and you enter an

Auto Bid amount of $18,000, your bid will automatically be placed at

$18,000. The Reserve Price has not been met so there will be no winning

bidder unless additional bids are placed.

C) If the

auction has a Reserve Price of $20,000 (this amount is hidden from

bidders) and you enter an Auto Bid maximum of $21,000, your bid will

automatically be placed at the Reserve Price of $20,000. If another

bidder jumps in, your bid will automatically increase until you meet

your $21,000 maximum bid.

What is a Flat Bid?

Flat

Bid is a one-time bid for the amount you indicate. Unlike Auto bid,

which automatically increases your bid amount to maintain your high-bid

position, when a Flat bid is placed — you will have to manually place

another bid to maintain your high-bid position.

What

is BuyNow?

A BuyNow auction means you can bid on the item one of two ways:

(1)

If you are willing to offer the BuyNow price before the first bid comes

in, you win the item immediately and the auction ends.

(2)

If you place a bid first instead of offering the BuyNow price, the

BuyNow option disappears. Then the auction proceeds as a regular online

auction.

BuyNow auctions are identified with the following icon: . You

MUST click on the BuyNow icon to choose this option.

What

is a Reserve?

A

reserve price is the minimum dollar amount a seller is willing to

accept for an item. This amount is not disclosed, but bidders are

notified (“reserve met” message appears on the auction listing) once

the reserve price has been met.

Why isn’t the reserve price disclosed?

The

seller has set the hidden reserve price to protect his or her financial

interests. It is the price at which the seller is obligated to sell.

What

is a Bid Increment?

A

bid increment is the minimum amount you can bid above the current bid

price. A bidder can place a bid amount that is equal to or greater than

the bid increment, just not less than the bid increment.

Can I place a bid for less than the Minimum Bid amount?

No. The Minimum Bid is set by the seller and is the floor at which

bidding begins.

Can I remove or cancel a bid?

Bidders

are urged to use the utmost care in placing a bid. A bid amount cannot

be removed or cancelled from an auction once it is placed. A bid is a

binding contract between buyer and seller; an irrevocable offer to

purchase an item from the seller at the stated bid price. Buyers are

required to conduct any research or due diligence of an asset prior to

placing a bid.

Can

I change my bid?

It depends on how you placed your bid.

If

you placed an Auto Bid, you may raise or lower your bid amount by

entering the new bid amount in the yellow bid box and clicking on "Bid

on this item".

Note: You can lower your bid amount only one bid increment above the

current bid amount.

If

you placed a Flat Bid, you cannot lower, remove, or cancel the bid. If

you have made a typographical error in your bid amount,(i.e. intended

to place a Flat Bid of $10,000 but accidentally typed $100,000) you

must contact Customer Service at service@Bid4Assets.com immediately to

report the error. During regular business hours (9am-7pm EST M-Th. and

9am-5pm EST Friday) you may call Customer Service at 1.877.4ASSETS. We

will review each situation separately and use discretion about honoring

your request. Bidders are urged to use the utmost care in placing a

bid.

Can

I increase my bid if I am the high bidder?

Yes.

If you are the current high bidder, you can increase your bid amount.

Enter your bid in the “Place Your Bid” box to submit a higher bid

amount. If you have a maximum Auto Bid amount that you would like to

increase, type the new bid amount in the yellow bid box and click on

the "Bid on this Item" button.

What happens if I am the winning bidder and I back out of the purchase?

All

bidders should be aware that they have entered into a legally binding

agreement if they place a winning bid on an auction on Bid4Assets or

Bid4Homes. Please see our Terms of Service, section 3.3 (b.) “offer and

acceptance – binding contract between buyer and seller.” Every bidder

must agree to the Terms of Service before bidding.

We take

bidder performance very seriously and expect every winning bidder to

complete their transaction. We vigorously enforce any violation of

policy.

A

“non-performing” winning bidder will be subject to the following

penalties:

If a deposit was required to bid, your deposit will be forfeited.

If

the auction does not require a deposit, bidders are required to have a

valid credit card number on file prior to placing a bid (Bid4Assets

will not charge the card or place a "hold" on funds). Non-performing

bidders will be charged a fee of $250 for real estate auction and $100

for all other auctions.

∑ For the first, non-performing,

offense: You will be automatically suspended from buying or selling on

Bid4assets and Bid4homes for 60 days. You must request re-instatement

in writing via email to service@bid4assets.com. Suspension will be

lifted 60 days after we receive your request for reinstatement.

∑ You will be permanently suspended from out site for a second offense.

What

is a deposit?

Most

government auctions conducted by Bid4Assets require interested bidders

to submit a deposit — specified by the seller — prior to placing a bid

on an auction. Following the auction, the Seller will receive the

deposit from the winning bidder as a purchase deposit payment for the

asset. If a winning bidder, for whatever reason, does not perform on

the auction their deposit is forfeited and their Bid4Assets account is

suspended. For more details and instructions on how to place deposit,

click here.

Note: Bid4Assets is currently Beta testing

offering deposit services to private sellers. The service is not yet

available site-wide.

What

is an Overtime period/What is Overtime Bidding?

Similar

to when an auctioneer continues to take bids until the last bidder

bids; B4A’s Overtime Bidding keeps an auction open for bidding until

there are no further bids for 5 consecutive minutes. Overtime bidding

occurs automatically when a bid is placed within the last few minutes

of an auction. The auction will remain open until an entire overtime

increment (5 minutes) has passed without any bidding. The overtime

increment is indicated on the auction listing page.

What

is a Buyer’s Premium?

Buyer’s

Premium is an optional fee that sellers can add to the winning bid

amount of an auction to cover costs associated with their auction. The

fee can not exceed 10% of the winning bid amount and is included in the

total purchase price paid by the buyer to the seller. The buyer’s

premium percentage is indicated on the auction listing and displayed

during the bid process. The seller is responsible for collecting the

Buyer's Premium from the Buyer.

What does the icon located in the Seller

Information box indicate?

All

sellers on Bid4Assets are authorized through an ID Verify process

provided by Verid Identity Verification and include the icon on their

auction listing page. Seller ID Verify significantly decreases Internet

fraud and our buyers are assured they are doing business with sellers

who are who they say hey are.

Benton

County Information

Before

we start let's look at some general information for Benton County. One

of the fastest and most convenient sources of information is Wikipedia.

Simply go to Google, Yahoo!, Bing or your favorite search

engine

and type in "Wikipedia Benton County Washington."

You should

be able to find some general information. I love to look at the

demographics and see whether the County is increasing or decreasing in

population and its size. Benton County is over 160,000 in population,

its increasing in size and it has some unique characteristics, like

vineyards and wine tasting. Remind me to make a trip. It's right next

to Oregon, which I know has some nice wines.

I also noticed that there are two Ghost towns, the Hanford Nuclear

reservation nearby, wildlife reserves, the Columbia River

General

Information

http://en.wikipedia.org/wiki/Benton_County,_Washington

To find the main county website, search on

http://www.naco.org,

got to "About Counties," click on Washington and find Benton County.

Or, if you prefer a search engine...type in a specific search, such as

"Benton County Washington Website."

Main County Government Website

http://benton.municipalcms.com/default.aspx

From the main website you should be able to find the Assesor and

Treasurer's office.

Treasurer

http://www.co.benton.wa.us/pView.aspx?id=846&catid=45

In

Washington you will find tax foreclosure sales information listed with

the Treasurer. If Bid4Assets weren't conducting the sale, this is where

you would find the tax sale list or call and ask about it. The

Treasurer's office will also have detailed information on each parcel,

such as the tax rate, delinquent taxes, tax history, etc.

Assessor -

Property Search

http://bentonpropertymax.governmaxa.com/propertymax/rover30.asp

The

Assesor's Office is where you will find the property value, owner's

name, site address, lot size, house description and much more. For

example, I just looked up one of the property's on the list and

although Bid4Assets has a ton of information, I had to look up house

size and number of bedrooms. Try this search by using the APN number or

type in this number 134084120002008.

If you really do some looking around, you will also find some nice

background information.

Also, keep in mind the actual tax sale foreclosure laws of Washington.

http://apps.leg.wa.gov/RCW/default.aspx?cite=84.64

Okay, that's it for the background, now back to the Bid4Assets site.

www.bid4assets.com

After the introduction, I am assuming that you've signed up if you want

to bid.

Step 1: Find

the List

Click on the Benton County link on the home page or go directly to this

link:

http://www.bid4assets.com/storefront/index.cfm?sfID=547

You now have three choices for going through the list.

1.

Bid4Assets website. The list is small enough that you can do all of

your research on the Bid4Assets site by clicking on the APN links. The

advantage of using the Bid4Assets site exclusively is the site show

redemptions or properties that have been withdrawn. The PDF file and

the Excel file do not show the update redemptions.

2. PDF file. A

PDF file is provided. Be careful with this file. The file has three

copies of the list. As I compared it to the Excel list, I wondered why

it was much larger in size. Well, it's a mistake. No problem.

3.

Excel file. My favorite option is the Excel file, even though I had to

update the redemptions. Why? I like screening and the speed of working

on my computer without relying on a superfast and continuos web

connection.

Click on the download file and open the document using Excel, Open

Office (Free) or another compatible spreadsheet.

Step 2:

Screen the list

Step 2:

Screen the list

Screen

number 1 is always for redemptions because I do not want to waste any

time looking at tax deeds that have been redeemed or withdrawn from the

sale. I first compared my Excel list to the properties shown on the

Bid4Assets site and removed the withdrawn properties. This reduced the

list from 30 to 14.

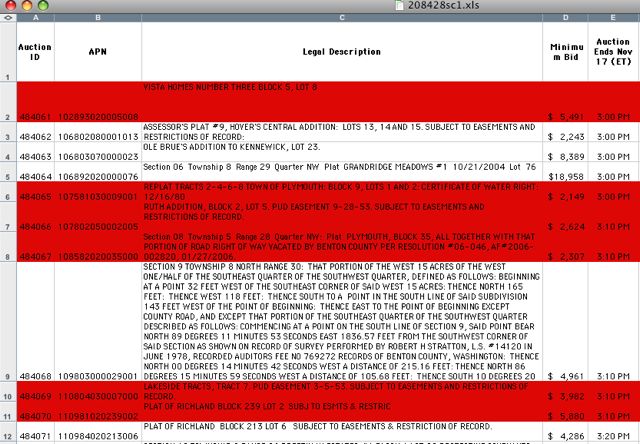

http://www.rogueinvestor.com/premium/lists/20842sc1.xls

Next,

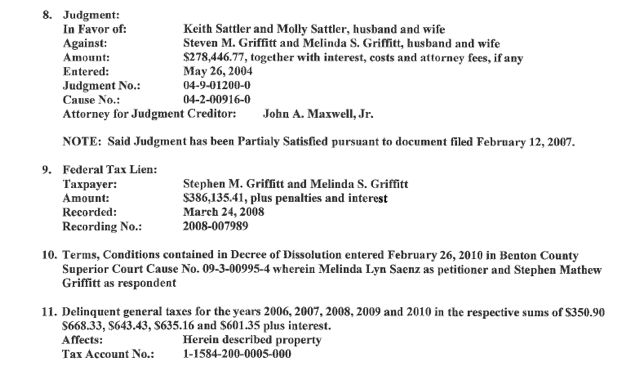

I like to try to find problem. I found two problems right away. Auction

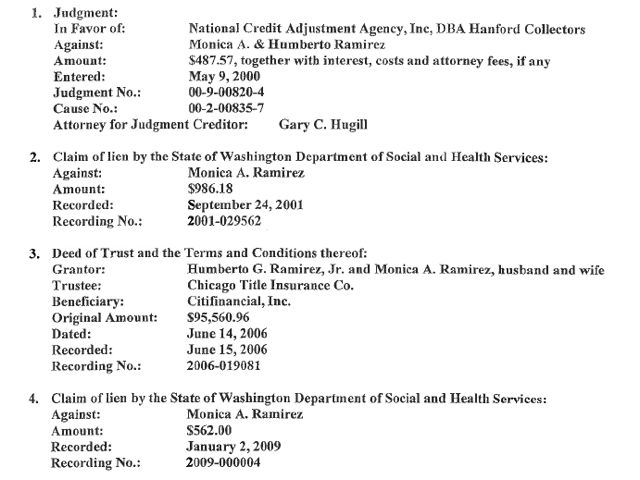

ID 484080 is a utility easement and probably has little value.

Property

484075 has an IRS lien as indicated in the spreadsheet and on the

Bid4Assets site. This may or may not be a huge problem. Go back to the

Bid4Assets site and scroll down until you see the title information.

Click on the Title Report link and read through the title report and

you will see that it is a mess. In addition to a huge judgment, there's

an IRS lien in the amount of $386,135. Ouch! I don't want to mess with

that.

This leaves me with a list of 12 potential properties/deeds.

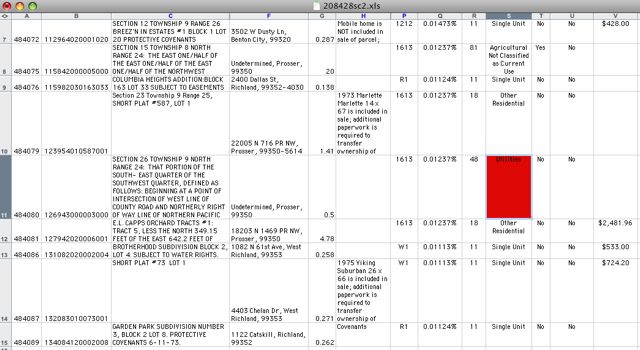

http://www.rogueinvestor.com/premium/lists/20842sc2.xls

Step 3:

Screen the list

I

see 12 potentials deeds. That's a manageable number so let's take

advantage of the fact that the County of Benton has done title work

mainly to protect its own interests. First, I typically start doing my

research from the back of the list. This is out of habit from lessons

learned in large tax lien sales where most of the better deals come

toward the end after everyone has exhausted energy and money.

Auction

ID 48409

This

is a nice property with a deed of trust (mortgage) in the amount of

$167, 544 and a credit line (second mortgage) for $5000. It's obvious

that the property owners have cashed out because the house (including

land) is only worth $173,250. Deeds of trust are similar to mortgages

except a trustee (third party) holds the deed. These are private liens

and will be wiped out through the tax foreclosure process. Keep an eye

on this one. I suspect it will be redeemed by Well Fargo (the lender)

before the sale. If not, they stand to loose $167,544.

Auction

ID 484087

This

is a mobile home that has not been registered properly. It also has

State judgments for $547 and $1355. State liens are not extinguished so

you would be responsible for paying the debt.

Please

remember the general rule:

Public

(government) liens are your responsibility, private liens are not.

- Mortgages or deeds of trust are private liens.

- Judgments are private.

- Mechanic's liens are private.

- IRS liens are public.

- State liens are public.

- City liens are public.

- Homeowner's associations are fighting to be

public - be careful.

- Water districts are probably public - assume

you will pay irrigation fees.

Auction

ID 484086

Not too much to be concerned with here. Credit

Union debt for $8000 and irrigation costs, but th house is worth

$108,870.

Auction

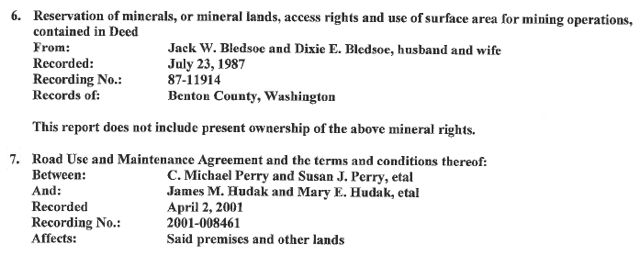

ID 484081

This

is an interesting property that has surface mining rights and easement

to get on and off the property probably for equipment. The house is

worth $209330 and includes 4.78 acres. This could be an environmental

problem is surface mining has been done. First, we need to know what is

being mined, the topography and rainfall amounts and water table level

to assess whether acid mine drainage could be a problem. This one may

be worthy of having someone do a driveby.

Auction

ID 484079

Auction

ID 484079

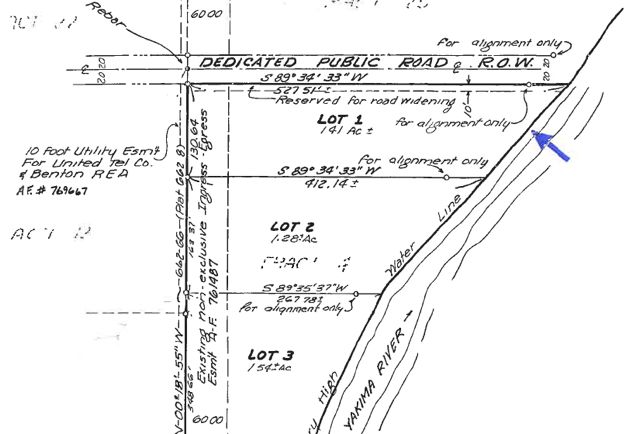

This

is an interesting Mobile Home property that is situated on 1.41 acres

next to the Yakima River. A deed of trust for 83,137 is present and the

property is worh $105,030. A question I have about this property is

flood zones and FEMA flood insurance.

Go to Fema.gov and click on map store to find out more information on

flooding and flood insurance maps.

Auction

ID 484076

Deed of trust for the same amount that the property is worth plus a

City lien of $2024 plus a judgment for $10829

Auction

ID 484075

IRS lien for $386,135 plus a judgment. This

one is ugly. Be careful.

Auction

ID 484072

Mobile home not included and 50% mineral

rights for 0il and Gas.

Auction

ID 484071

Modest home $57470.

Auction

ID 484068

This

is a crazy shaped lot. Just look at how long the legal description is.

You have to be a professional land surveyor to even understand it. If

you are considering this lot, I wouldn't certainly put a call into the

Assessor's office and ask a lot of questions. Is it buildable, for

example?

Auction

ID 484064

Homeowners association fees and a deed of

trust for $256,500 for a $302,750 house.

Auction

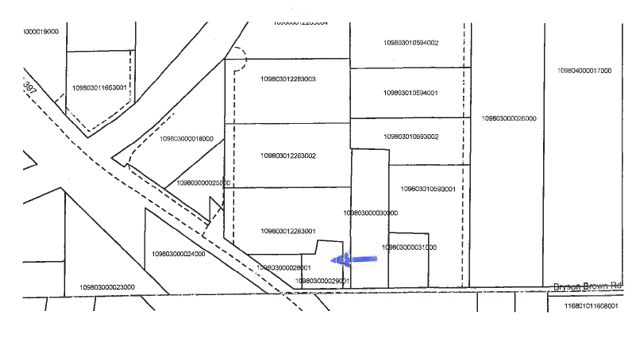

ID 484063

State health liens present.

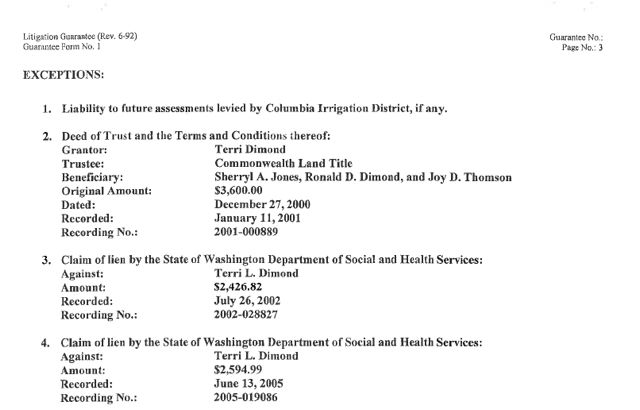

Auction

ID 484062

Watch out for state health liens of $2426 and

$2594. You will be responsible for paying these government liens.

In

summary, be prepared to add the cost of any irrigation fees, city,

state, IRS or other public liens. You will not have to worry about

deeds of trust or mortgages, they are removed through the tax

foreclosure process.

So now what do you think? It's still early, but pick your favorite five

and assume 3 of the 5 will be redeemed before the sale.

Now how high do you bid?

First, you study the last year's sale. 2009 Stats are shown at this

link:

http://www.co.benton.wa.us/UltimateEditorInclude/UserFiles/Common/Document/2009_Tax_Foreclosure_Sale_Results_12-31-2009_051941.pdf

Benton County, Washington Results

of 2009 Tax Foreclosure Sale

|

Sold |

Assessed |

Min. Bid |

Overbid |

% of Value |

| 1 |

$18,300.00 |

$35,680.00 |

$3,526.00 |

$14,774.00 |

51.29% |

| 2 |

$1,600.00 |

$350.00 |

$1,118.00 |

$482.00 |

457.14% |

| 3 |

$983.00 |

$350.00 |

$983.00 |

$0.00 |

280.86% |

| 4 |

$1,468.00 |

$4,740.00 |

$1,368.00 |

$100.00 |

30.97% |

| 5 |

$4,900.00 |

$23,950.00 |

$3,041.00 |

$1,859.00 |

20.46% |

| 6 |

$6,300.00 |

$23,950.00 |

$3,041.00 |

$3,259.00 |

26.30% |

| 7 |

$5,400.00 |

$2,790.00 |

$1,118.00 |

$4,282.00 |

193.55% |

| 8 |

$19,600.00 |

$30,860.00 |

$3,350.00 |

$16,250.00 |

63.51% |

| 9 |

$29,200.00 |

$41,160.00 |

$4,321.00 |

$24,879.00 |

70.94% |

| 10 |

$3,801.00 |

$13,000.00 |

$2,514.00 |

$1,287.00 |

29.24% |

| 11 |

$5,000.00 |

$2,700.00 |

$1,103.00 |

$3,897.00 |

185.19% |

| Ave. |

$8,777.45 |

$16,320.91 |

$2,316.64 |

$6,460.82 |

53.78% |

| Note:

one deed was not sold and not included in the averages. |

As you can see, the results vary from some properties being sold for

well below the assessed value to some being sold for much more. Keep in

mind, any land more than about 1 acres will often be assessed at a much

lower value. So we would need to do more research on the actual values;

however, this provides a rough idea of what to expect. It also fits in

with my expectations of not paying more than about 50% of a property's

value at a tax deed sale.

Assignment

1. Go through the current list and prioritize it based upon your

expectations of paying 25% and 50% of its current value. Check the

county's value with Zillow.com and Trulia.com and see how different

they are.

2. Based upon the discussion above, calculate what your true overbid

amount would be. Remember if you are considering a property that has a

government lien, you have to add that into your costs.

Extra Credit

Go through the 2006, 2007 and 2008 results and see how they compare

with 2009.

Results for 2006, 2007 and 2008 linked from http://www.co.benton.wa.us/pView.aspx?id=846&catid=45

Very Best,

Michael