Dear Premium Members:

One of the most important things to

remember about tax lien investing is that in most counties, sales only happen once a

year. That's why it is important to understand the calendar of events.

Speaking of calendars, click here to download the latest tax sale calendar (December 2010 and January/February 2011):

http://www.rogueinvestor.com/Tax_Sale_Calendar.pdfpassword = taxsales

As

you know, last month we featured an online tax deed auction. This month

I want to take the knowledge that we have from when tax sales occur and

combine it with an understanding for which states have over-the-counter

investing.

That's why I am profiling an over-the-counter tax lien list from Colorado.

In

Colorado most sales are held in October and November. Liens that are

not bid on during the annual sale are struck off or assigned to the

County. These liens are referred to as "county held." The liens are fresh because the sales just happened. With OTC liens you want the lists as fresh as possible.

Before we profile the list, let me briefly review Colorado:

- Interest Rate = 9% plus the Federal Discount Rate (total of 10% in 2010 due to low Fed Discount Rate).

- Redemption Period = 3 years from the date of the original sale, not when you buy the lien.

- Premium portion of bid only applies to the annual sale, so you do not have to overbid with county-held liens.

- Colorado operates different types of auctions, but again you do not have to worry about that with county-held liens.

- Treasurer's office - this is the agency that collects taxes and conducts sales.

Pueblo County Example

Step 1

To

find the list, visit your favorite search engine and type in "pueblo

county colorado treasurer," or we have a companion site you may visit: http://www.coloradotaxliencertificates.com.

You should be able to find this link: http://www.co.pueblo.co.us/treasurer

(mouse over "Government" and then over "Elected Officials to find the link to "Treasurer").

Navigate

on the Treasurer's site (see header for "Tax Lien Sale Procedures") and

find the county-held list. It will be in a pdf format

that you will need to download. As I have mentioned before, pdf (Adobe

Acrobat) format is one of my least favorite formats for lists, because

you cannot manipulate the list in any way (as you can with an Excel

list). I wish

counties would understand what a pain it is to deal with, but hey that

keeps it fun.

Step 2

Sometimes with a pdf file you will be able to copy and paste into a spreadsheet.

Oftentimes, you need to first copy the file into a text editor and then

into Excel. The Pueblo County OTC list will not work because it is not formatted evenly,

so don't bother. We will have to work with the clunky pdf file.

The file is also loaded on our server for convenience (downloaded on 12/5/2010):

http://www.rogueinvestor.com/premium/lists/countyheldadvert.pdf

Step 3

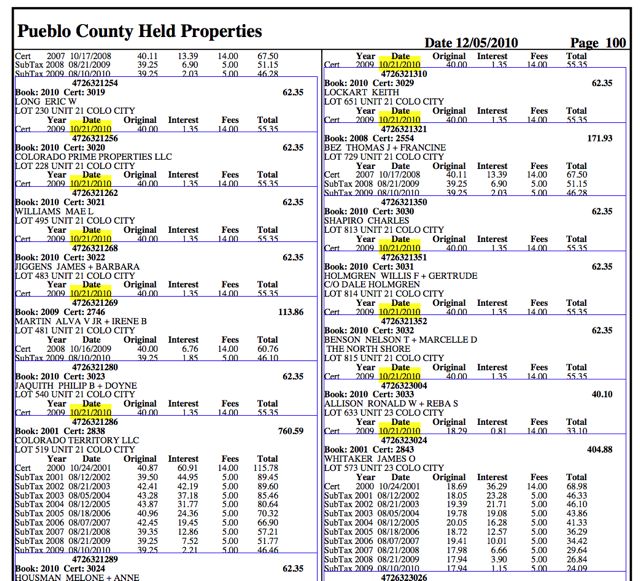

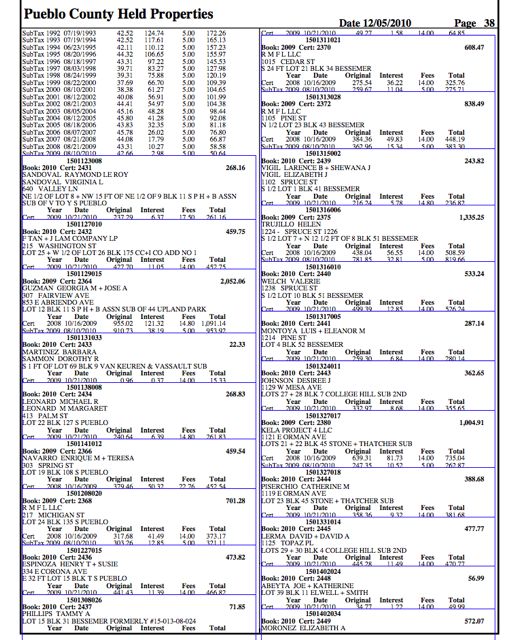

Go through

the list and do a rough screen. Normally, I would have you first check

for redemptions. However, first look through the OTC list and

check for the most recent liens or deeds. In this case, go through the

list and check for 2009 liens that were sold in the October 29, 2010

(10/29/2010) sale.

These are the most recent. Do not consider

liens that have multiple years. That means liens listed with 2005,

2006, 2007, 2008, 2009. These liens continue to be delinquent year after

year and there is probably a good reason. Your time is too valuable to mess with junk.

Next,

use a minimum value of approximately $200 for one year's taxes and

screen out everything below that value. The $200 cutoff is arbitrary, so

you may establish whatever criterion you like. That's because the

liens priced too cheaply are probably cheap for a reason. Their value

is most likely limited. Start with the most valuable liens and then if you have time go back to the cheaper liens.

As

you screen through the list, keep it open on your computer with your

Internet access intact, because the County has linked each of the liens

directly so you can do your research.

When you click through a lien to

the County's website, check and see if there are improvements on the property or if it's

just raw land. Improvements typically mean a house or structure.

Therefore, if the improvement value is zero, then you know it is only

land.

Also,

note that the Assessor's office has rated any improvements as

"Average," "Below Average," etc. Below average probably indicates that

the property needs several thousand dollars worth of repairs or

improvements.

Step

4

Now, let's go

through an example. Page 38 of 163 has several interesting liens to

note. Even though I said to only look at the 2009 liens, I might

sneek a peak at a couple of the liens that are 2008 and 2009 based upon

their values.

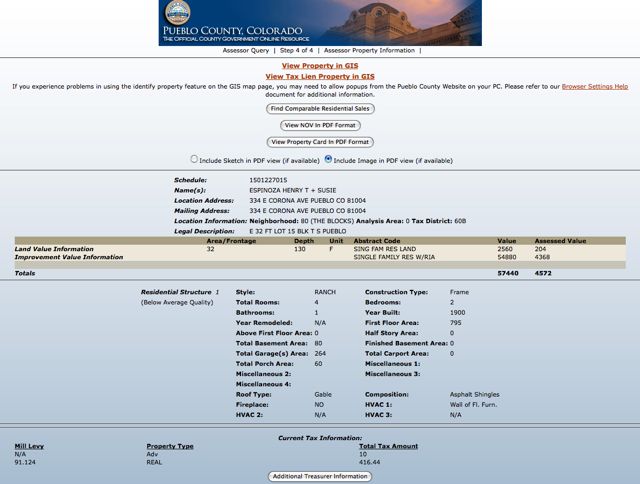

As an example, let's look at Cert 2436 for $473.82, Parcel Number 1501308026.

If

you click on the lien, you will find that it is valued at $57,440 and

the County says it is below average in quality. Do you see the land

value and the improvement value? Together, they make up the entire

value. Also, do not get confused with assessed value. That is a County

term, which is typically a percentage of the true value. It is used to

calculate taxes.

What

else can we glean from this page? The property address and the tax address are the

same, indicating that it is an owner-occupied house. It is held in

joint-tenancy by a married couple. These two items indicate that they

are likely to pay their taxes within the three-year period or risk

losing their home. This is either good if you like the interest and not

messing with a property, or it's bad if you hope to foreclose.

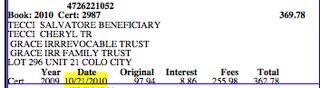

Here

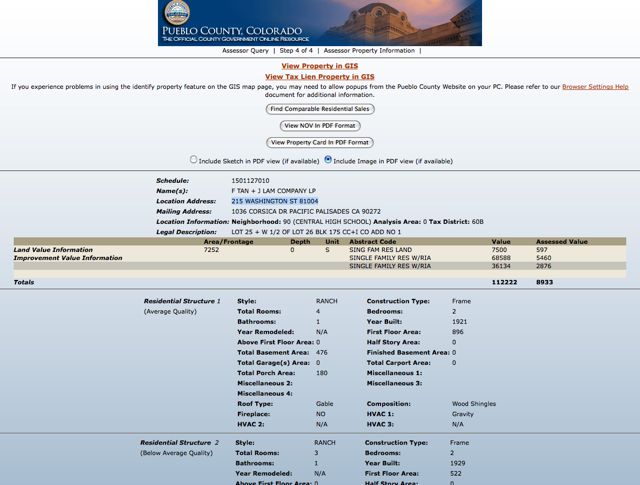

is another example to look at. This property is identified as Cert

2432, owned by F Tan + J Lam Company LP. The taxes owed are $459.75.

Furthermore, it is parcel number 1501129015.

Notice that

there are two structures on this property. The total value is $112,222.

Both houses are two-bedroom ranches with 1 bath. The owner's mailing

address is in California so the property is probably a rental. This one

gets me interested. For only $459.75 (more or less - the County will

tell you the final amount of taxes owed), you will buy into a lien

earning 10%. If not redeemed in one year, I would buy the next year's

taxes. If not redeemed, I would then buy the third year's taxes.

At the end of three years, you will earn 10% interest or foreclose on a property with two rentals valued at over $100,000.

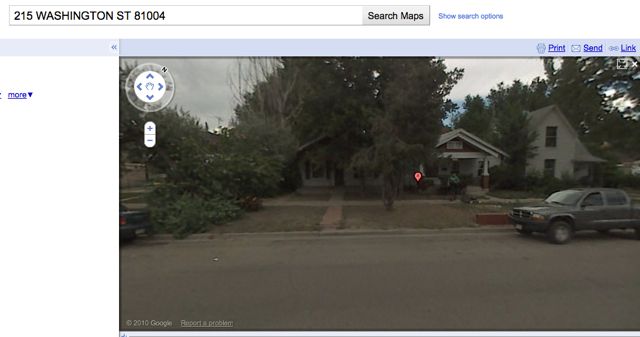

I

would love to check out this property in person, but that's an 11-hour

drive for me or a flight. So, another option is to look it up on Google

Maps with Streetview or Bing and see what it looks like.

Note the two houses located on the same property.

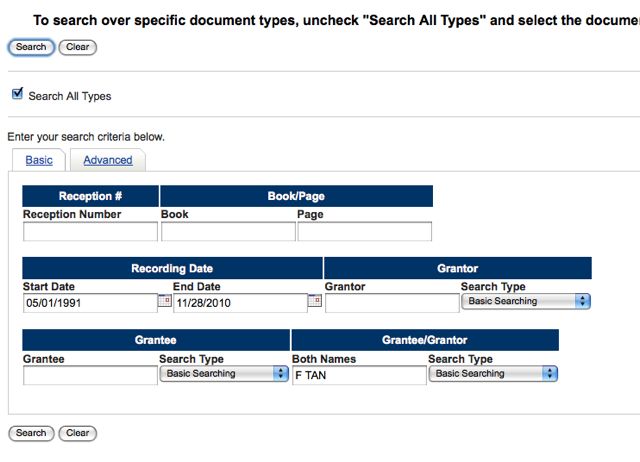

Finally, search the Grantor/Grantee Index for othe liens, judgments,

deeds and ownership verification. Start with one name in both the

Grantee/Grantor index and also try the other name.

What are you looking for?

- IRS liens

- State or city liens

- Mortgages,

but your tax lien holds superiority. If you see a mortgage or deed of

trust, then chances are the mortgage company will redeem and pay you

off at some point with interest so they don't lose their investment.

- Judgments, zoning problems and anything out of the ordinary.

Please

understand that you have to look this up by owner, even though you may

find other houses or properties that the owner has bought or sold,

which do not apply.

Again, to find this go back to the main County website and look for the Clerk/Recorder.

Now,

let's do this. Work through these and together we'll come up with our

top 10 picks. Please remember that your top 10 may be different

depending upon your goals (interest vs. ownership; land vs. homes,

commercial vs. residential).

I will post my top 10 list on Thursday.

I should also mention and make

it clear that the three-year redemption period starts from the date of

the sale; consequently, you can screens OTC lists like this one looking

for liens that have already exceeded the three-year redemption and

purchase the lien, then immediately start foreclosure.

How to buy?

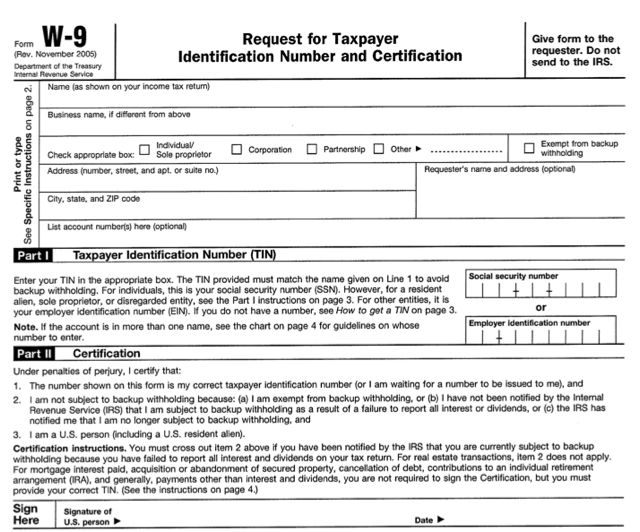

Print

out and fill out the W9 form. This can be found on the left hand side

of the Treasurer's website or by going to IRS.gov and typing W9 in the

search box.

Use certified funds, such as a cashier's check made out

to Pueblo County Treasurer.

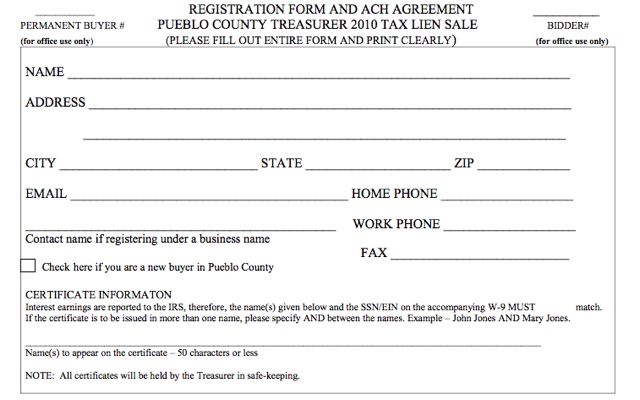

You will also need to list your name,

address, phone number and the name that you want on the lien. For

convenience the County has a Registration Form that was used for the

regular sale. You do not necessarily have to use this same form for

county-held liens, but I'm sure it would keep things much simpler.

The

County will keep the actual certificate in their possession and you

will receive a receipt. You will be notified next year to pay

subsequent taxes if you want.

Manage your liens

1.

Keep a file folder of the physical paper work along with any other

information, such as the research you did on the value from the

Assesor's office.

2. Use a speadsheet, like Excel or

Money-management software, to manage the liens. Set up a calendar

reminder of what you own and where.

Wishing you the best,

Michael

P.S. There are all kinds of things on this list, such as:

- Mobile homes - you will recognize these because they have a manufacturer's

name, year and VIN (vehicle identification number). These are not

necessarily bad investments, just know what you are buying a lien on.

- Severed mineral interests.

- Lots, land, open space that is unbuildable.

Have fun, but BE CAREFUL.