St.

Joseph, Indiana Commissioners' Online Tax Lien Sale

Indiana is one of my favorite states for tax lien investing. Every year

Indiana conducts tax lien sales from roughly August through October,

depending upon the county. Several of the Indiana counties have gone

online and their service of choice is SRI. Any tax liens that are not purchased at the regular sale are made

available through the Commissioner's sale. Before I discuss this sale,

I would like you to understand the tax sale laws of Indiana. TAX LIEN CERTIFICATE SALES The

public auction or "Tax Sale" of real property is required by Indiana

law. The statute governing tax sales in Indiana is Indiana Code (I.C.)

6-1.1-24 and 25. The law requires: that

all properties with delinquent taxes, penalties, and special assessment

liens for unpaid sewer user charges, delinquent weed cutting fees,

delinquent solid waste service fees, delinquent storm water fees,

delinquent health and hospital liens, and DMD liens as specified by law

be auctioned at the Treasurer's Tax Sale.

The

law allows the County Auditor and County Treasurer, who are responsible

for the tax sales, options regarding the manner in which the tax sale

may be conducted. Therefore, the exact procedures by which a county

conducts a tax sale for properties with delinquent taxes and special

assessments may differ from county to county. Tax Sale Date:

Typically, tax liens are sold once a year and the sales can be held any

time during a year, based upon the first collection of taxes. Indiana

law requires the County Treasurer to provide to the County Auditor on

or before July 1st a list that certifies all tax sale eligible

properties as of that date. Tax sale eligible is defined as any entity

that is delinquent from the prior year’s spring installment. Tax sales

must be held no later than 171 days after the list is certified to the

County Auditor. Eligibility:

A person (or an agent of a person) who owes costs directly attributable

to a prior tax sale, delinquent taxes, special assessments, penalties,

or interest may not purchase property in a tax sale other than their

own property (I.C. 6-1.1-24-5.3[a][5]). Bidding Process: Indiana is a bid-up state. In otherwords, you start bidding at the

minimum bid and increase your bid until you win. For online auctions

it is typically done by proxy, meaning that you can set your bid at your

maximum and the program will bid for you in the required increments

until you win. If you are outbid, you will be notified and have a

chance to increase your bid. Minimum Bid: Property at the sale will not be sold for an amount less than: - the delinquent taxes and special assessments on each tract or item of real property,

- the

taxes and special assessments on each tract or item of real property

that are due and payable in the year of the sale, whether or not they

are delinquent,

- all penalties due on the delinquencies,

- an amount prescribed by the county auditor that equals the sum of:

- the greater of twenty-five dollars ($25) or postage and publication costs; and

- any other actual costs incurred by the county that are directly attributable to the tax sale, and

- any unpaid costs due under subsection (b) from a prior tax sale. (IC 6-1.1-24-2[a]).

Redemption Period:

The redemption period for A items (properties not in the last year’s

sale) is one year after the date of the sale of the certificate (I.C.

6-1.1-25-4[a]). Subsequent Taxes:

During the period between the tax sale date and the expiration of the

redemption period and prior to the issuance of a deed, the certificate

holder may pay all taxes, assessments, penalties and costs due for the

property. Immediately upon paying for any of these additional costs,

the certificate holder should report the payments to the County

Auditor's office with the receipts to record them. The certificate

holder can be reimbursed for those taxes (plus interest at the rate of

10% per annum) upon redemption if he files a 137B form. Redemption Fee: The redemption fee is calculated in two parts (three parts if taxes are paid subsequent to the tax sale): 1. On the Minimum Bid: - 110% of the minimum bid if redeemed not more than 6 months after the date of sale

- 115% of the minimum bid if redeemed more than 6 months but not more than one year after the date of sale.

2.

On the difference between the successful bid price and the minimum bid

(referred to as tax sale overbid): 10% per annum interest from the date

of payment to the date of redemption. 3. On any taxes and

special assessments paid by the certificate holder subsequent to the

sale: 10% per annum interest from the date of payment to the date of

redemption. 4.5 and 4.6 Notices:

Not less than three months prior to the expiration of the redemption

period (12 months from the date of sale), the certificate holder must

send a Notice of Sale by certified mail to the property owner and any

person with a substantial interest in the property. The Notice must

include all the information required in I.C. 6-1.1-25-4.5. These

notices are referred to as “4.5 Notices.” It is typically

recommended that the certificate holder initiate a title search on the

property to identify the legal owner and any persons with a substantial

interest of public record prior to sending this notice by certified

mail. If the property is redeemed, the property owner will be required

by law to reimburse the certificate holder for her actual paid title

search expenses, not exceeding the amount established by the county, if

a form 137B was filed with the County Auditor prior to the date the

property owner redeemed the property. Indiana law does allow the

certificate holder to file a request with the court to be reimbursed

for an amount greater than the ceiling set by the county for title

search and noticing and attorney fees. The certificate

holder is further required (by I.C. 6-1.1-25-4.6) to send a “4.6

notice” to the interested parties after a year from the sale to notify

them that the redemption period is over and a deed petition is being

filed. Filing Deed Petition:

If the property has not been redeemed, the certificate holder must

petition for a tax deed to the real property within six months after

the expiration of the redemption period. If the tax lien purchaser

fails to do so, the lien against the property is terminated according

to I.C. 6-1.1-25-7(a). All delinquent taxes, penalties,

and/or special assessments which became due subsequent to the tax sale

must be paid before the County Auditor will petition the court to issue

a tax deed to the certificate holder. Penalties for Failure to Comply with Tax Sale Statutes: There are three important penalties to bear in mind: 1.

Failure to Pay Amount Bid: A high bidder who fails to pay the County

Treasurer in a timely manner the full bid amount for the subject

property, in acceptable funds, will have his bid cancelled and be

required to pay a penalty of 25% of the amount of the bid, subject to

prosecution (I.C. 6-1.1-24-8). 2. Failure to Give Adequate

Notice to Owner: A certificate holder who fails to fulfill the

requirements for issuance of a court order directing the County Auditor

to issue a tax deed (i.e., fails to give adequate or timely notice or

provides insufficient supporting documentation) may be required to pay

a penalty equal to 25% of the purchase price. The certificate holder’s

petition for a deed under I.C. 6-1.1-25- 4.6 also may be rejected. 3.

Failure to Give Notification and/or Petition Court: A certificate

holder who fails to provide notice or provides insufficient notice as

required by I.C. 6-1.1-25-4.5 (i.e., fails to notify the property owner

and persons with a substantial property interest of public record to

the tax sale and date of expiration of the period of redemption) may be

required by the court to pay a penalty equal to 100% of the purchase

price. COMMISSIONER’S SALE OF TAX LIEN CERTIFICATES Properties

that do not sell at the regular, "A" tax sale in the fall have a tax

lien certificate issued to the County Board of Commissioners. Indiana

law allows the Commissioners to sell the tax lien certificates, convert

certificates to a tax deed, or do nothing with the certificates. A

second sale of certificates is called a “B” or “expedited” sale. The

reason it is referred to as an “expedited sale” is that the period of

redemption is shortened to 120 days from the date of the sale of the

certificate for the property owner, and the buyer can receive their tax

deed more quickly. (The redemption period of “C” items, which are

marked for redevelopment, is also 120 days.) I.C.

6-1.1-24-6.1 authorizes the Commissioners to sell a tax lien

certificate at a “B” tax sale for an amount that is less that the

amount required at the “A” tax sale. COMMISSIONER’S County-Owned Surplus Sales If

a parcel has gone through the annual tax sale and is not purchased, the

county takes a lien on the property. As discussed above, the County

Board of Commissioners may sell these tax lien certificates at a

second, “B” sale. Alternatively, the county may take title

to any property for which it holds a tax lien by virtue of a tax title

deed, following the same procedures as a lien buyer. (The County

Commissioners may request a tax deed from the County Auditor 120 days

after the tax sale ends.) The property is appraised and a minimum bid

amount established. At the auction, bidding starts with the

minimum bid, with the highest bidder winning the property. There is no

redemption period at a surplus auction. No property may be

sold to a person who is ineligible under I.C. 36-1-11-16. This means

that anyone who is purchasing property previously held by them or by

their principal and that was forfeited because of delinquent taxes

within the last five years, must submit timely payment to the County

Treasurer of all past due amounts. The property is conveyed

from the county to the winning bidder by quitclaim deed, which the

county records. The parcel is owned by the buyer as soon as she

receives the recorded tax deed. Under a new law in 2007, however,

buyers will not be issued a deed until any delinquent property taxes

are made current on property they currently own. Failure to bring all

delinquent property taxes current may result in the voiding of sale of

the parcel, application of money rendered to the delinquent taxes, and

the resale of that parcel in a subsequent sale. According to

state law, the tax deed vests in the grantee an estate in fee simple

absolute, free and clear of all liens and encumbrances “created or

suffered” before or after the tax sale except those liens granted

priority under federal law and the lien of the state or a political

subdivision for taxes and special assessments which accrue subsequent

to the sale and which are not removed by state law. The property is, however, subject to: - all easements, covenants, declarations, and other deed restrictions shown by public records

- laws,

ordinances, and regulations concerning governmental police powers,

including zoning, building, land use, improvements on the land, land

division, and environmental protection

- liens and encumbrances created or suffered by the grantee.

According

to state law, the tax deed is prima facie evidence of valid title in

fee simple in the grantee of the deed. It is also prima facie evidence

that the sale of the real property described in the tax deed was not

irregular, and that all proper proceedings were conducted in a regular

manner. The most recent update of the Indiana Tax Sale Laws is presented here: Indiana Tax Sale Laws (pdf format) - updated for 2010 SRI Online and the St. Joseph County

Board of Commisioners' Tax Lien Sale

Step 1: Sign Up With Online Auction Company

Sign up with SRI Online Auctions and obtain a username and password: https://www.sri-onlineauctions.com/ Once you have signed up you will need to visit this affiliated site also run by SRI: http://www.sri-taxsale.com/

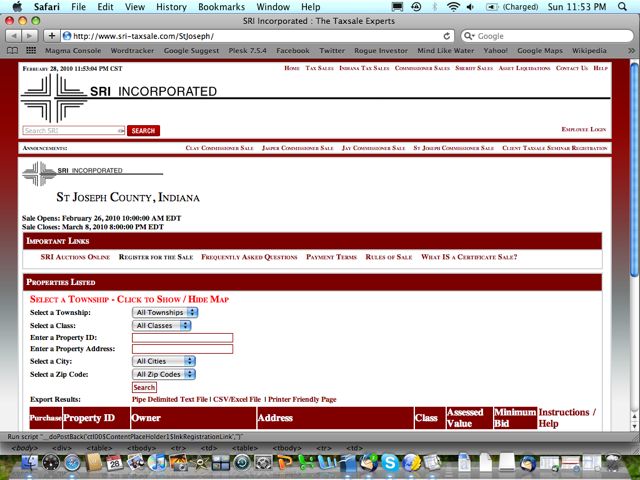

Step 2: Sign Up With County

You will then need to sign up with St. Joseph County to participate in the online auction.  Step 3: Rules of the Sale

Step

4: The List

Download

the list that is provided in Excel or comma delimited

format or use the online database and perform searches based upon your

personal criteria. If you download the list, note that you will

probably need to check for redemptions on the database or online system.

In other words, your downloaded list will be accurate as of the date it

was downloaded, but maybe not a day later or even a few hours later. To

find a tax sale list it is not always as easy as typing in a search

engine. The problem is counties control the lists and they do not care

about optimizing websites for Google or Yahoo! The

first

thing to know is which government agency runs the sale. You will need

to check with

the Tax Collector or Treasurer of each county or municipality. In some

cases, the Department of Revenue or Sheriff's Office may run the sale.

Either type in "St. Joseph Indiana

County Tax Collector" in your favorite search engine or better yet go

to

www.naco.org and find "about counties" and search for the county website

(more on this in a separate lesson). Step

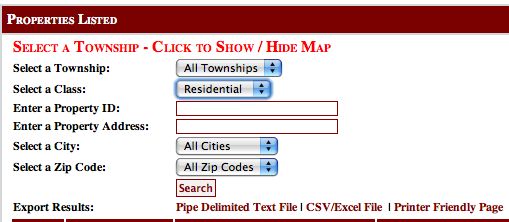

5: Screening

One

of the most important concepts in tax lien investing is to be able to

screen lists and come up with what you are potentially interested in

buying. For example, if you are only looking for

residential properties, then enter "residential" in the class of

property. If you prefer searching for agriculture or industrial, then

use those search parameters. As you can imagine, residential properties

typically offer less risk, but more competition.  Location

is also a great way

to screen properties. If you are only interested in certain

neighborhoods or you want to avoid others, then screen out your list

using these criteria. You can search for properties within a given

township, city or zip code. A map is even provided for the township

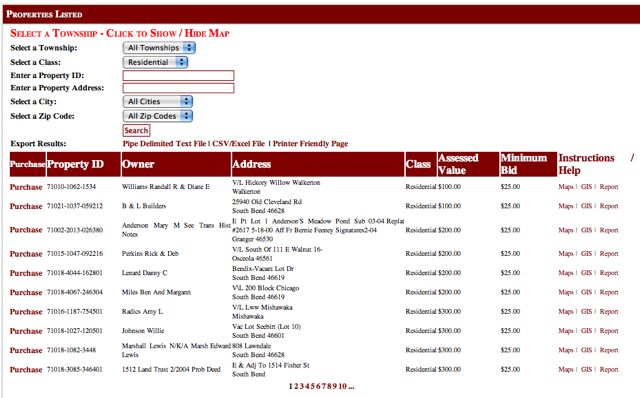

designations. Be sure to press the "search" button. Using a residential screen of properties in all cities and

townships, you will see that there are more than 10 pages returned, so

we really need another screen. Place your cursor on the "Assessed

Value" header, which is a link, and click. This will re-sort your results

so that the first liens/properties listed are the cheapest. If you

click one more time, it will sort with the most expensive or highest

assessed value properties first. You can do this with "Minimum Bid" and

achieve about the the same results because the minimum bid or taxes

owed will usually be a reflection of the value of the property, unless

multiple years of taxes are due or other taxes are included. Screening

by Assessed Value or Minimum Bid is a great way to remove less

desirable properties with little value. For example, an assessed value

of $100 indicates to me that the property probably has little value. It

is most likely a small lot or piece of land in an undesirable location.

As a check, pull up one of these properties in the report and see if a

value is listed under the "REALIMPROV", which stands for real estate

improvement or house. Land will have no improvement value.  Remember,

you can also download the CSV/Excel file and setup search criteria

that go beyond the online system. Simply click on the Excel link and

download the file. Then, open Excel on your computer and open or import

the csv (comma separated) file. If you have troubles, like I did, use

the "pipe delimited" text file. Click on the link and save the file,

then open it with Excel or another word processor, such as the one

provided with Open Office for free. Experiment

with various

searches and notice the links on the right hand side. The report link

will show you the general information for the property. This is the

kind of information that you will normally search for at the county

assessor's office or website. In this case it has been provided so we

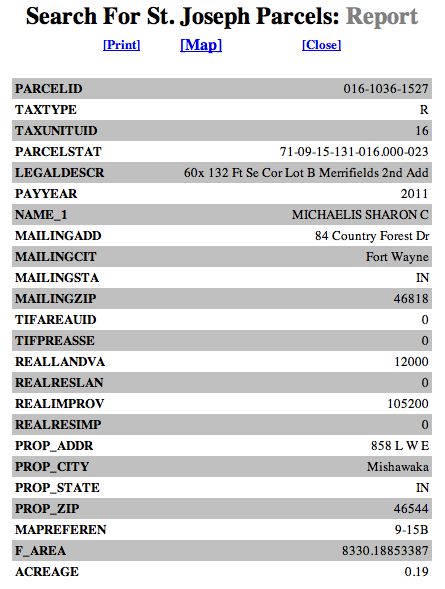

are one step ahead.  PARCELID - This is the properties identification number, much like we

have a social security number, each property has a unique parcel I.D.

number. TAXTYPE - R = residential. LEGALDESCR -

The property's legal description or where it is located. Tax sale lists

generally have to indlude the legal locator and not necessarily the

address or situs as it is sometimes called. NAME_1 - The property owner's name. It can be a company, person, trust, etc. MAILINGADD

and PROP_ADDR - Notice that in some cases the mailing address and the

property address are the same and in some cases they are different. If

different, the property may be a second home, rental property, or

investment property. REALLANDVA - This is the property's land value REALIMPROV - This is the property's improvement value, or the value of buildings or structures on the property. Step 6: Due Diligence

Important! Due diligence is done after you have screened your list down to a manageable level.Now,

your first step in doing due diligence is to click on the map links and

view the property using Google maps or

Google Street View. This has been provided and it is an incredible

resource. Pan around the site and look at the neighbor's property. Try

to notice if there are any suspect areas, such as gas stations, power

substations, mines, landfills, railroads, industrial complexes,

military facilities, airports, sewage treatment plants or anything that

could reduce the real or perceived value of the property. What

is the value of the property in comparison to the taxes owed? On some

lists you will be amazed to find out that the taxes owed or minimum bid

actually exceeds the value. What about IRS liens or other problems? Visit

the county recorder's office or clerk's office and look for recorded

documents. Mortgages, deeds, liens, etc. have to be recorded. To find

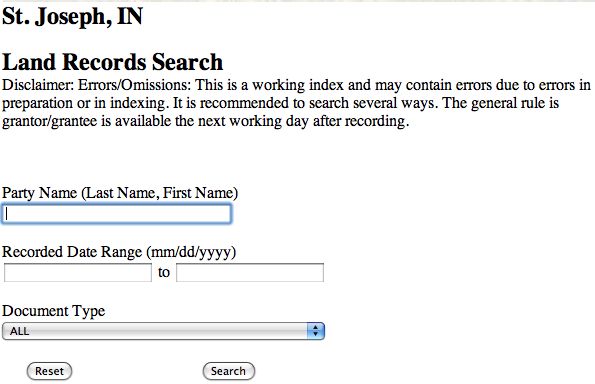

the recorded documents for St. Joseph County, visit http://www.stjosephcountyindiana.com/departments/SJCRecorder/default.htm and click on free record search. This

type of search is done through what is called the "Grantor/Grantee"

index. When you search this index, you need to search by property owner

name and if more than one owner is listed, search all owners'

names.  What about environmental problems? What about environmental problems?A great resource for searching for major environmental concerns, such as hazardous waste sites, is located at http://www.epa.gov/enviro.

This site allows you to search for Superfund sites, hazardous waste

sites, petroleum or gas stations, toxic or hazardous handlers, etc. You

should also know that every state has its own environmental program. In

Indiana it is the Indiana Department of Environmental Management: http://www.in.gov/idem/. What about flooding?Using your favorite search engine, type in "FEMA Map Store" and go to FEMA.gov What about bankruptcy?Bankruptcies

are often recorded with the county government; however, bankruptcy is a

federal process so it is best to check with the federal district court. There

are 2 U.S. District Courts in Indiana: Northern District Court and

Southern District Court. Each district court has a separate bankruptcy

court. U.S. Bankruptcy Court – Northern District of Indiana: http://www.innb.uscourts.govYou

can call the clerk’s office and ask for bankruptcy information for a

specific person. Alternatively, especially if you have several names to

check, you can call an automated line that will give you bankruptcy

information (e.g., file date, discharge date, etc.) for a specific

person. Bankruptcy Automated Line for Northern Division = 1-800-755-8393 Step 7: Purchase

When

it comes time to purchase you should remember in Indiana that you earn

interest on the bid up so if you have found a lien on a property of

value, then the idea is to bid it up enough to win the bid, but not so

much that if you have to foreclose on the property, you paid too much. The

key here is to set boundaries. You want a good deal and you want to

leave plenty of room for making mistakes. Everyone is different, but I

personally do not bid over 50% of the value because I want plenty of

room for a good deal. With competition down and the number of liens and

deeds up, you may want to consider bidding much lower - 10% to 20% over

the mimimum for example. The proxy bidding will help you, so you are not overpaying.

Step 8: Manage Your Liens or Deeds

It

is important to remember that your liens have a redemption period. You

have to maintain your liens and pay subsequent taxes to maintain your

first position. If your lien is not redeemed, you will need to keep

track of any expenses related to foreclosing. Plan on setting up a filing sytem, both physically and electronically. We'll talk more about this very soon.

All the best,

Michael

|