As

you know by now, tax lien sales are governed by state laws, some of

which dictate one sale per year. In some cases, you literally have to

wait until the next year to invest in that state. In other cases, state

laws allows for tax lien certificates and tax deeds to be sold through

another process.

This process is referred to as

over-the-counter, by mail, sold to the state, county held, struck off

or many other names. In general, it means you can buy directly through

the county or state and sometimes earn the maximum interest.

FloridaAlthough

I will not be talking about Florida over-the-counter sales, I want you

to keep track of the lists and find out which liens are available. That

is because the best time to purchase OTC liens is right after the

sales. Florida sales just ended on June 1, so now is a great time to

purchase. You will earn the full interest rate. You just need to be the

first in line - by mail, phone or internet.

Florida has OTC liens and OTC deeds.

Let's find a list for an example of each:

Search

for Citrus County Tax Collector. Their annual sale was held on via the

Internet, but if you search for County-Held Certificates, you might be

lucky enough to stumble upon this link:

http://www.tc.citrus.fl.us/sale_certificates.htm

For

OTC Deeds and Tax Deed Sales held as the need arises, you must search

on the Clerk of the Circuit Court's website: OTC Deeds are called Lands

Available.

http://www.clerk.citrus.fl.us/nws/home.jsp?section=8&item=88

AlabamaSales

also just occurred in Alabama. I will be sending out a special report

on Alabama. In the mean time, please keep in mind that these lists are

fresh, but it usually takes a little time for the counties to update

the lists.

They

are all available as sold to state properties. You do not need to

purchase the list, contrary to what Jefferson County (Birmingham, AL)

says.

Alabama calls their over-the-counter liens/deeds

"Sold-to-State" land or properties. The entire list is presented for

every county at this one link:

http://www.revenue.alabama.gov/advalorem/transcript/transcript.htmIn

short, what you need to know about Alabama is liens automatically

become deeds in 3 years so if you are looking at the list and the lien

is older than 3 years, you are buying a lien that has matured to a deed.

I will save this discussion for when it looks like the list has been updated.

Texas "Struck-Off" Tax DeedsIn

Texas, deeds that are not purchased at auction are referred to as

"resales" or "struck-off" properties. In fact, if you attend an auction

in Texas and no one bids on a property, the Constable conducting the

sale will say, "Property XYZ is struck-off to the County." This allows

the county to sell the deed directly to you.

It is important

to remember that the redemption period for deeds in Texas is six months

for all properties other than homestead or agriculture properties,

which have a redemption period of two years. The redemption period

starts from the date of the tax sale auction, so if you are looking at

a struck-off list of non-homestead/non-agriculture properties older

than six months from the date of the sale, you are buying a deed with

no right of redemption period remaining.

On the other hand,

if you find Texas struck-off properties that were recently added to the

county's list, the redemption period may not have expired. In Texas,

property owners or others with an interest in the property can redeem

by paying the taxes, fees and penalties plus your 25% interest for the

first year or 50% for the second year.

The truth is that

most struck-off properties will be deeds, which is fine with me. I get

excited about buying property for less than 50% of its market value and

you should, too.

Why consider Texas "struck-off" properties?

In

many Texas counties there are more liens and properties available than

potential bidders. In some counties, the lists are so fresh that county

personnel or attorneys who represent the county are surprised to see

someone asking for the list.

So, what are the secrets to investing in Texas "struck off" properties?

1. Learn how to screen through the lists.

2. Do your research and due diligence just like you would with any type of real estate.

3. Find fresh lists. Remember, many Texas counties have sales each

month, so keep checking for updated struck-off lists.

4. You need to know how to navigate the Texas system. Every county is

different and the agency or law firm that handles the tax sale auctions

is often not the same agency that handles the struck-off sale process.

How do you find the lists?

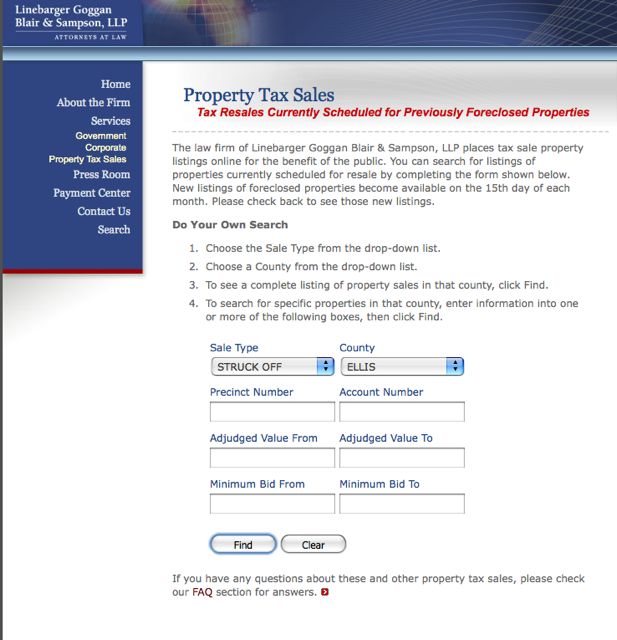

Many counties are handled by only a few law firms. Here is an example of one of the law firms.

Visit the Publicans website, which is Linebarger Goggan Blair & Sampson, attorneys at law:

http://www.publicans.com

Click on

"Property Tax Sales" on the home page, and then on "Texas Tax Sales." This

takes you to a page with frequently asked questions and answers, as well as

a link for "Tax Sales Property Listings." Click on that link.

Step 2: Select a County and List

There are three types of sales listed:

resale, struck off and stayed no bid. A resale is a public sale of a

struck-off property (i.e., a property that did not sell at the first auction).

A struck-off is a property that, depending on the county, you can either

submit a written offer to purchase (a private sale), you can participate in a

sealed bid procedure, or you can request that the property go to a resale.

Here we will screen for a struck-off property in Ellis County.

Now that you have done your research, contact the attorney's

office.

Waxahachie Office

216 W. Franklin Street

Waxahachie, TX 75165

p: 972-923-5154

f: 972-937-2878

In this case, I learned that to purchase a struck-off property in

Ellis County, which I have never done, you must notify the county of the property you are

interested in and they will put it up for resale at a public

auction. This is not a county in which you can purchase directly through the mail.

If

you are dealing with a larger county like Travis County, they operate

their own struck off properties so you will deal with the county

attorney and submit a bid for review. The review process may take a

week or two and it will need to be approved at a county meeting.

I have purchased struck off properties from this county and the process is straightforward.

Once

approved, they will provide you with a final purchase amount and you

will submit a cashier's check. The county will then record the deed in

your name or your company's name and a Sheriff's deed will be sent in a few weeks.

Step 8: Homework

Find the Travis County struck off list and screen it for 3 potential deeds that are available right now.

Has the redemption period ended?

Are any of the deeds homestead?

Do any of them look worthy?

How often does Texas have sales? Texas Struck Off lists are updated every _____?

When does the redemption period start?

I will personally work with you on Travis County or another county of your choice.

All the best,

Michael