Dear Premium Members:

This month I want to use a live list to profile one concern that

occasionally comes up and that is Internal Revenue Service (IRS) liens.

If you live in the United States, you are quite familiar with this

agency. The IRS is charged with collecting federal tax revenue from

individuals, businesses and other entities.

Unfortunately, the agency has been granted enormous powers that include

the power to levy liens on real or personal assets. From our

perspective we are concerned about liens placed on real estate because

IRS liens are NOT extinguished through the tax foreclosure process.

So let's look at a list. I happen to know that Washington State

conducts many of its sales during the months of December and January so

I checked our

Tax Sale Calendar list to see what was available. I chose Thurston County in Washington.

Thurston County has a sale in early January and it is an Internet auction run by Bid4Assets.

Visit:

http://www.bid4assets.com/storefront/index.cfm?sfID=732.

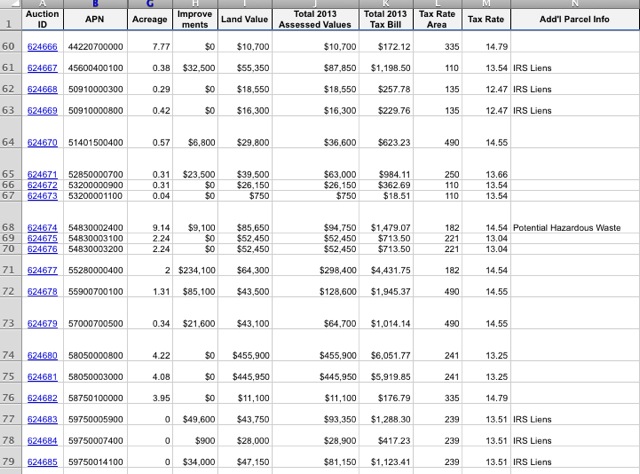

When you visit the site, you will see the list of properties presented

on the website or as a downloadable file in Excel and PDF formats.

Click on the property list and download the Excel file. You will notice

under Additional Parcel Information, some properties have IRS liens. In

the case of tax deed properties, you could literally buy these

properties and the IRS would still have 120 days to redeem and pay you

back, typically with interest at 6%. Otherwise, after 120 days they

lose their rights to the property.

This brings up a few issues. First, if you want the property, find out

how much the IRS liens are for. In a some cases, it may be worth paying

off the IRS liens after you purchase the deed. In other cases, it may

be worth knowing whether the IRS plans to redeem; however, it is likely

they will not discuss the lien until you are the owner.

IN EVERY CASE, make sure you understand how much the lien is for.

Okay, before we go any further, let's review what an IRS lien is...

What is an IRS Federal Tax Lien?

An Internal Revenue Service (IRS) federal tax lien arises when a

taxpayer fails to pay any tax after a demand by the IRS for payment.

This is a statutory lien based on section 6321 of the Internal Revenue

Code (IRC). The lien is sometimes called a “secret lien” because it

exists as a matter of law; the filing of a notice publicly announcing

its existence is not required.

Even though the lien can be perfected without the filing of a notice,

filing is important in establishing the IRS’s priority against other

claimants to the taxpayer’s property. IRC 6323(f) provides the rules

for filing a notice of a federal tax lien against real property. For

real property, the notice is filed in the office designated by the

state where the property is located. For most states, the notice is

filed with the land records in the county where the property is

located. The residence of a corporation of partnership is the place

where the principal office is located. A notice of federal tax lien for

a taxpayer who resides abroad is filed with the Recorder of Deeds for

the District of Columbia.

The IRS has created the Automated Lien System (ALS) to generate notices

and releases of federal tax liens. The information is released to the

state recording offices and the District of Columbia Recorder of Deeds.

When a notice shows an assessment is more than ten years old, the IRS

is required to refile its notice of tax lien within a one year period

ending ten years and 30 days after the date of the assessment.

Links to all of the county recorders by state can be found by visiting

the All Things Political website. Under County and Local Websites,

click on County Recorders. Click on the state you are interested in,

and on the next webpage scroll down a little to find links to the

county recorder offices.

Example from the Thurston County, Washington List

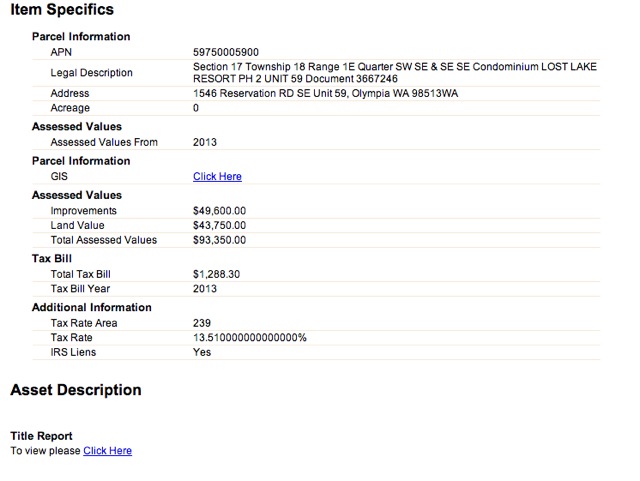

Auction I.D.: 624683

APN or Parcel Number: 59750005900

Legal Description: Section 17 Township 18 Range 1E Quarter SW SE & SE SE Condominium LOST LAKE RESORT PH 2 UNIT 59 Document 3667246

Minimum Bid: $9,383

Auction Ending Time: 2:30 PM

Address: 1546 Reservation RD SE Unit 59, Olympia WA 98513

Acreage: 0

Improvements: $49,600

Land Value: $43,750

2013 Assessed Value: $93,350

Total 2013 Tax Bill: $1,288.30

Tax Rate Area: 239

Tax Rate: 13.51

Additional Parcel Info: IRS Liens

How to Investigate the IRS lien.

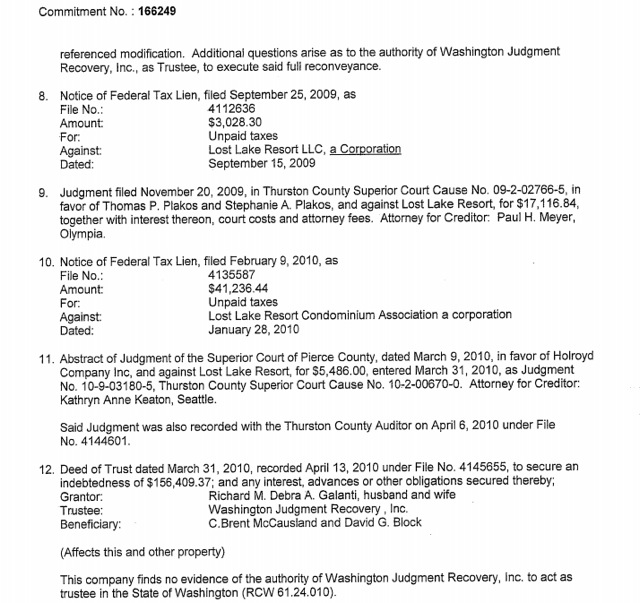

In this case, Bid4Assets has made it easy for us by providing a title

report for each property. Find the property online by searching through

the APN numbers. Our APN is 59750005900.

1. Go to the Thurston County Washington website.

http://www.co.thurston.wa.us/home/index.asp

2. Click on Elected Offices and Departments.

Find the Clerk's office.

http://www.co.thurston.wa.us/clerk/

3. Click on Records Search. You may have to sign up for an account.

4.

Investigate and see if you can find the lien on the County Recorder's

website. This is where you will find recorded liens, such as the tax

lien itself and any IRS liens.

***Send me any questions.......

All the best,

Michael